Digital Transformation in Banking: Current Trends

In the last few years, the face of banking has irrevocably changed. One of the examples is the emergence of a new banks breed known as “challenger banks” – financial institutions focused on providing exclusively digital services and minimizing customer interaction with a bank.

First introduced in the UK, the phenomenon of challenger banks has expanded immensely. Today, there are nearly two hundred challenger banks operating worldwide, and their number is growing. And this became possible with the rise of such innovative technologies as blockchain, AI, and others making their way into the banking sector.

So what is digital transformation in banking? In this blog post, we will overview 3 current digital banking trends in 2022, specifying changes each technology brings to the industry.

What Is Digital Transformation in Banking?

Digital banking transformation is a necessary step to improve how banks and other financial institutions learn about, communicate with, and meet the demands of their clients. To be more specific, knowing digital customer behavior, choices, and requirements is the first step towards a successful digital transformation.

Emerging technologies such as artificial intelligence (AI), blockchain, cloud computing, the internet of things (IoT), robotic process automation (RPA), and virtual reality (VR) are rapidly enhancing the current financial landscape and expanding their reach into previously untouched domains:

- Banking operations analysis and risk management. A fraud detection system and multi-level transaction validation prevent potential customer and banking staff errors.

- Transaction times are reduced through quick operations. Microservice-based design in Big Data processing systems allows for quick and secure transaction processing.

- Data management with increased security. Banks are protected by data encryption systems from fraudulent cases of external and internal data leaking to hackers. Furthermore, the transactions are carried out in a secure manner.

- Predictive opportunities. Knowing what challenges are likely to arise in the future is crucial to your financial success. The reliable information on several scenarios of a global economic catastrophe will assist you in planning ahead of time. As a result, you’ll be able to make sound business decisions and implement successful Fintech solutions before moving your company to a more promising and financially rewarding industry.

What Are the Key Areas of Digital Transformation in Banking?

Customer Journey

Traditional customer journeys or sales pipelines frequently begin with marketing generating leads, then transferring those leads to sales, and finally to customer service. Before receiving a product or service, a person must go through multiple departments, resulting in a disjointed, disconnected, or often impersonal outcome.

Digital transformation allows you to build a more seamless and personalized customer journey. Creating a digital customer journey entails integrating everything into a single online platform so that the customer is dealt with using the same tools, by the same people, and with the same information throughout the process. Changing how teams are organized, integrating technical personnel into sales teams, and possibly merging marketing and retail into one team can all help a lot in this situation.

Understanding and investing in consumer demands and requirements is part of digital transformation in banking. It will, however, save you money in the long run because it enhances customer satisfaction, frees up employees for value-added activities like relationship building, and automates operations.

Digitalization and Big Data

Data is more abundant in modern banks than it has ever been. The more digital services you provide, the more data you will acquire automatically. This information enables you to make significant progress in terms of upgrading and managing your operating model, customer service, and even corporate strategy. Data enables you to gain a deeper understanding of your customers, allowing you to spot opportunities, improve products and services, and automate processes.

In banking, data mining and big data are used across the board, but sales and marketing are two of the most prominent areas that profit from the information supplied by a bank’s digital transformation strategy. Big data helps you to establish customized marketing campaigns or financial education programs based on consumer information. Analytics can predict when customers want or need loans, when loans default, when customers are about to depart, or even when a cross-sell or up-sell might be beneficial. As a result of this information, banks are able to provide highly customized offers and solutions, whether through a representative or as an automated solution through an app or web portal.

Focus on Change

While there are numerous facets of digital transformation in banking, one of the most crucial is the ability to adapt to change. Security, legislation, and tight procedures designed to protect client data and privacy sometimes hold banks back. In terms of growth and user acquisition, new digital-native banking products and apps are exceeding traditional banking. Digital transformation in banking necessitates adapting policies to match changing consumer demand, rapidly adapting to new technology, and responding to changes in the market.

Digital transformation in banking requires transforming the company from the inside out, focusing on how the business responds to change rather than on outward services like web portals and chatbots. To develop and maintain a truly digital organization, you’ll need both.

Many banks today are failing to achieve their own digital transformation objectives, proving that digital transformation is easier said than done. Banks can make this shift by changing their approach, replacing legacy frameworks, and actively developing a digital culture internally. Digital platforms and services, especially when enabled by automation, AI, Big Data, and blockchain technologies, can provide a significant lot of value to consumers.

Which Digital Banking Trends Will Be Dominant in 2022?

Each of the trendy techs highlighted below has already impacted the banking sector, continues to do it, and can also be considered as one of the digital banking future trends, as their influence on the industry will grow.

Digital Mobile Banking

In the modern world, quality customer service in banking is no longer associated with standalone buildings crowded with people. Instead, it is more focused on providing 24/7 distant services with reduced human interactions – both achievable with the emergence of banking mobile apps. In other words, the competition is for the easiest-to-use apps, where deposit checks, funds transfers, and applying for loans are possible anytime and from every location with Internet access. What is more, there are several requirements best digital banking apps should address. These are:

- Simple yet secure sign-in

- Bank account management

- Intelligent chatbot for customer support

- ATM locator

- QR code payments

- Alerts and notifications

- Track of spending habits

- Cashbacks

- Special offers

- Apps for wearables

- Shared finance features

There is one more technology we cannot overshadow – mobile pay. The number of stores set up to accept mobile payments is growing along with customer satisfaction, leaving no space for questions on how innovation in digital banking enhances the customer experience. Here are the main advantages that outgrow from the implementation of digital mobile banking.

When it comes to the future of digital banking, it is best described with the word “omnichannel”. What does this mean? The answer is the app that offers access to banking operations through different channels, such as a website, mobile app, call center, or any other. So the best omnichannel software is the one that provides access to all possible channels.

Blockchain

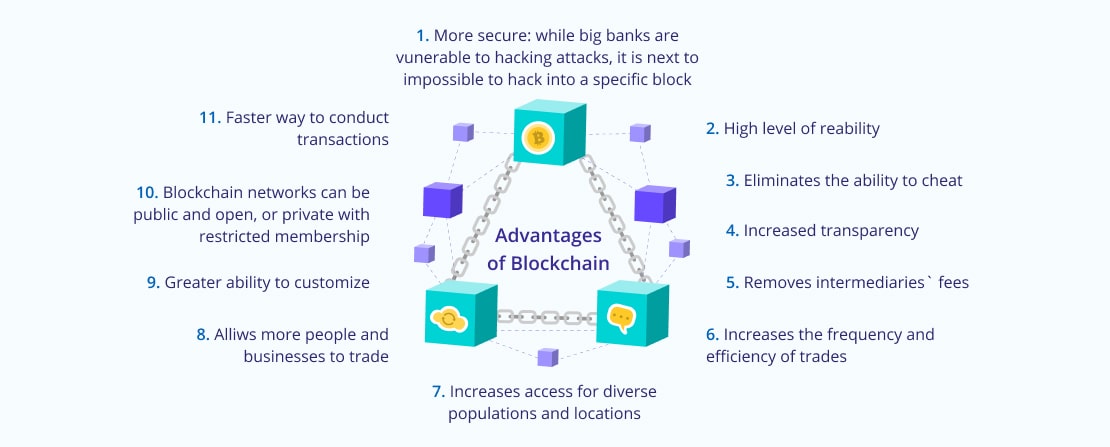

Digital innovation in the banking sector will not be possible without blockchain technology. It is predicted to have a notable impact on digital payments, escrow services, loan processing, as well as many other areas requiring utmost security. Today, the technology is used by some banks for:

- Payments (cross-border, peer-to-peer, corporate, and interbank);

- Private equity asset transfers;

- Tracking derivative commodities;

- Management of trading, spending, mortgage and loan records, etc.

The future of digital banking will also witness blockchain used for automating processes that need to meet certain regulations before being executed. As for now, here are the main benefits already offered by blockchain:

Artificial Intelligence

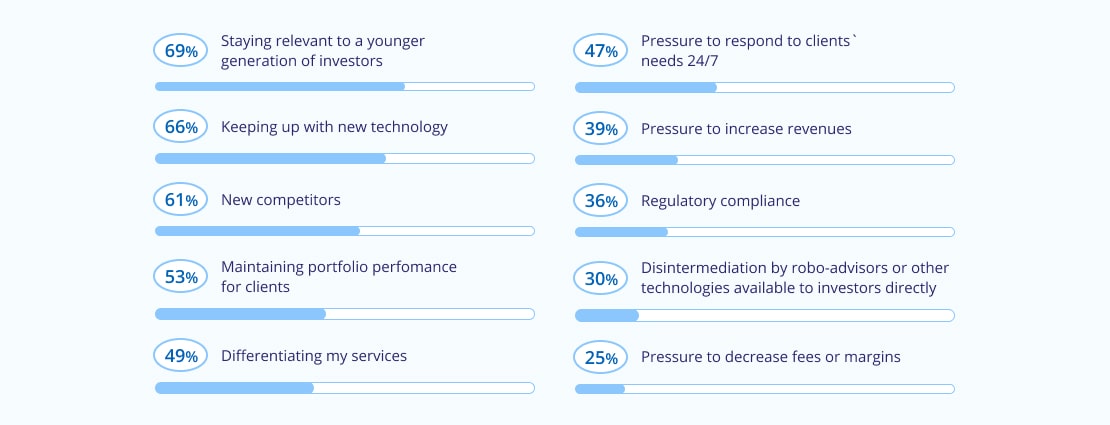

Being one of the most trendy technologies, AI is used in nearly every industry, and banking is no exception. Among its numerous use cases, the most promising one is represented by automated wealth managers. To see all the benefits this technology brings, let’s first take a look at the greatest concerns wealth management is facing today.

So how can automated wealth managers address the above-mentioned issues and why this technology is believed to be one of the worthiest digital transformation examples in banking?

In short, it allows investment banking digital transformation. AI-driven bots open up space for defining the best investment opportunities, best interest rates, and best loan providers. The technology is considered to be solution number 1 for those planning to stay on top of the investment prospects.

Bottom Line

It is obvious the banking industry is experiencing a digital revolution. While its future will definitely be affected by new advanced technologies, changes to the banking industry have already started, and there is no better time to adopt trendy techs to keep up with modern times and answer growing customer expectations.

With swipe cards, ATMs, card readers, and sensors already used in the sector, the era of new trends in digital banking has come. So if you have any ideas concerning technological improvements to your existing banking services, feel free to contact us. Being a reliable banking software development partner, getting to the next level of providing banking services with SCAND banking solutions is easy and satisfying for both businesses and their clients.