The Rise of Banking as a Service

The Banking and Finance sector has always been the most cautious about the quick adoption of digital technologies and innovations. Sensitive data and security issues, as well as the performance of complex operations, kept banking institutions away from providing online services for a long time. Customers had to visit banks’ brick and mortar facilities and spend hours in long queues to handle various operations.

However, the growing competition for clients and the necessity to keep pace with innovations have urged many banks to turn to digital transformation.

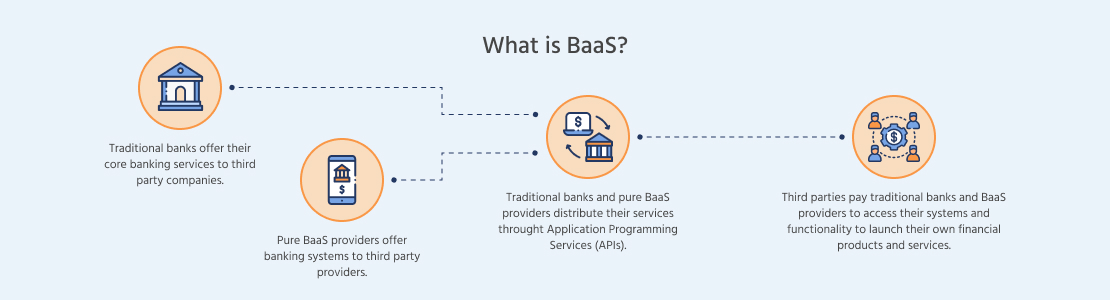

Banking as a Service (BaaS) is one of the quickly growing trends that banks and financial institutions successfully implement to reach wider audiences. BaaS unlocks new opportunities for banks and non-financial institutions, allowing them to blend their services into high-quality digital solutions that effectively cater to the needs of the most demanding customers.

In this article, we’ll uncover what Banking as a Service is and explain how many banks and non-financial institutions can benefit from implementing BaaS solutions.

What Is Banking-As-A-Service?

Banking as a Service (BaaS) is a process when a bank provides seamless integration with its IT systems through open API, smart contracts, and distributed ledger technologies.

Banks are providing various fintech and non-fintech organizations with their back-office services like Amazon or Google lease their infrastructure services.

Bank as a Service allows any business to integrate all the financial instruments it needs into its business processes, completely customizing the bank for its purposes.

This practice eliminates the necessity for organizations to build their own banking apps while saving time and money on development from scratch.

Here are examples of the services that BaaS provides today:

- Card processing and payments

Non-financial companies can use Banking as a service to add payment functionality to their platforms or apps. This way non-financial companies can lower their operating costs as they don’t need to develop and maintain their own banking infrastructure.

- ID verification

With BaaS platforms it’s easy to plug into banks’ KYC (Know your customer) systems. They help fast identify and verify customers’ identities before processing payments and prevent fraud or money laundering.

- Credit arrangements

Various retail sectors like eCommerce, Travelling and Booking, and others can provide an opportunity to open a loan by using a special BaaS API. Formalizing a credit online saves time and helps to avoid paper routines.

- Enhanced customer experience

Different companies can integrate their services into one and provide their clients with a smooth customer experience. Besides that, such service blending helps banks to grow their customer bases by providing BaaS services to companies from various niches.

- Online banking services in an app

Some FinTech companies can provide personalized banking services like spendings accounting or even start their own online-only banks which can offer all the services a customer can receive in a brick-and-mortar facility.

The History of BaaS

The banking and finance sector digitization has always been going slow. This is mainly caused by sensitive data security issues. Nevertheless, with the development of digital technologies and cyber security strengthening, banks and financial institutions started adapting them first for improving their inner workflows and calculations and later to provide a better customer experience.

The first online banking service was launched in 1997 by Sumitomo Bank. However, the mass adoption of online banking started only in the 2000s. For example, Statista says that in 2007 in the UK 32% of people used online banking services whereas in 2022 the figure has risen to over 90%.

Banking and financial institutions’ digitization hasn’t stopped only at providing online services through tailored financial applications. Today, banks have moved further and begun to offer Banking as a Service (BaaS). It works similarly to white labeling when a business takes products manufactured by third-party companies, puts its brand label on these products, and sells them as their own. But, this time, instead of products, companies use banking services. They add the services to their platforms or applications with the help of APIs to improve their customer experiences, e.g. offering special debit cards with a point-credit system for each purchase, providing loans to buy the company’s products, and much more.

BaaS started with the facilitation of online payments on other non-financial platforms. Embedded online payments have opened new revenue opportunities for many online platforms and gave impulse to the development of e-commerce platforms.

Currently, BaaS is growing further and the number of banking services provided via BaaS has increased tremendously. They can be: providing special loans and discounts to the businesses that use the BaaS of a particular bank, personal loans to non-financial platform clients, simple payment processes, checking and saving accounts, wealth management, overdraft services, credit and debit cards, compliance with regulatory requirements, and many others.

Banking-As-A-Service Industry Outlook

BaaS services are gaining momentum right now. A wide range of companies across various industries view BaaS as a successful strategy to increase their revenues and minimize their customer churn rate.

According to the Future Market Insights survey, the BaaS platform market revenue grew up to $2.5bn in 2020 and is expected to reach $12.2bn by 2031, growing at a CAGR of 15.7% in the forecasted period. Meanwhile, the Finastra survey predicts that the BaaS solutions will provide a $7tln opportunity to various distributors such as retailers, e-commerce companies, and others. Therefore, it’s expected that the migration towards BaaS solutions will exceed 70% per year over the next three years.

The most successful blendings of BaaS FinTech providers and retail banks that have started their own BaaS platforms are SolarisBank, Bankable, Treezor, Cambr, ClearBank, and others.

Apart from purely BaaS platforms, there are also the banks that rely on BaaS solutions and provide B2C services such as Starling Bank, Fidor Bank, BBVA, and many others.

Google announced they are going to partner with banks to check their consumers’ accounts, Apple starts its own credit card brand with special offers and Facebook incorporates Venmo in its payments tools with a more robust data collection.

This outstanding growth in BaaS implementation means a profound transformation of banking systems and the existing non-financial platforms as well as the emergence of new digital solutions to embrace BaaS. This way, the upcoming BaaS trends will involve:

- Increasing application of BaaS in a variety of industries

- Booming development of financial services applications

- Bank platforms modernizations for the provision of BaaS

- Close collaboration of diverse non-banking organizations with banks via BaaS platforms

- Faster dissemination of alternative banking services such as Neobanks, Buy Now Pay Later, alternative credit scoring, and more.

Benefits of BaaS

To keep the leading positions in today’s digital trends, many banks start their own BaaS platforms. This allows them to establish close partnerships with FinTech companies that help these banks to become mainstream and open sources to additional revenues.

Here is the main benefits BaaS brings to various businesses and their customers:

- Wider audience reach – banks expand their audiences by providing their services to non-financial platforms.

- Increase in customer lifetime value – adding BaaS to a commercial platform simplifies the process of acquiring financial services for the platform users and provides a wider diversity of payment methods, e.g. via a credit card, by small installments, etc.

- Minimization of customer churn – customers who can receive all the services like payment processing, using credit or debit cards, etc. in one place are more likely to visit the platform again for more purchases.

- Increase in revenue – banks can charge small fees from the platforms or platform customers for using BaaS. Meanwhile, the platforms can provide their customers with flexible payment options encouraging them to spend more in one place rather than drifting off to other platforms.

- Improved customer satisfaction – embedded financial services makes payments easy and swift. Customers don’t have to switch between payment systems, nor navigate complex banking requirements. As a result, the payment process turns into a smooth journey that can be entirely completed online even if it’s a bank loan.

- Improved security – business platforms that collaborate with banks via BaaS, have to comply with a wide range of bank regulatory requirements like KYC as well as provide banks with their payment and transaction histories. This makes them a more reliable platform for banks and for customers and reduces the possibility of fraud.

How Does BaaS Work?

BaaS is a complex system that needs to be secure and reliable, involves strong authentication and data protection measures, and complies with the banking laws of the user location.

There are several ways how to connect to BaaS:

API-Based BaaS Stack

Software developers use Application Programming Interfaces (API) to connect their digital solutions to BaaS platforms.

API-based BaaS stack includes a three-layered structure:

- Infrastructure-as-a-Service (IaaS) includes traditional licensed banks that provide common financial operations.

- Bank-as-a-Service is a layer that goes above traditional banking. It represents a software layer with a number of services that are customized for various FinTech startups and other financial companies. This layer ensures that the data travels between a traditional bank and a FinTech company.

- The FinTech ecosystem layer includes the companies that interact with end-users. They receive users’ data and requests on performing financial operations and send all these to BaaS layer platforms.

Cloud-Based BaaS Stack

Another way to use banking in your web application is to tap into secure widespread Cloud services.

Some tech companies obtain their own banking licenses and can operate as regular financial institutions. These companies don’t need to rely on traditional banks anymore. Therefore, they redefine their BaaS stacks, turning them into Cloud solutions. For example, Amazon Web Services having a banking license can provide its users with IaaS and server hardware infrastructure.

Amazon can go even further and turn its platform into Banking-as-a-platform (BaaP) or FinTech Software-as-a-service (SaaS) facilities. It means that now any company can benefit from Amazon’s banking platform by plugging into its infrastructure and using banking services on demand. All this results in the virtualization of traditional banking services and ensures their seamless and quick implementation in any web application.

How to Get Started With BaaS

Before adding financial services to their platforms, non-financial organizations have to consider a wide range of aspects: the services they and their customers require, the BaaS provider, and the process of BaaS integration into their systems.

The first and most common option for most non-financial platforms is to embed payment services into their solutions. This will allow companies to minimize the payment complexity for their customers as well as increase the use of their services among them. Banks usually provide ready-made solutions in the form of APIs to integrate into the platforms. Therefore, the platform owners don’t have to worry about complicated funds management whereas customer onboarding requires the buyers to just one-time data sharing.

BaaS services aren’t limited only to a payment gateway integration and there are many other financial services companies can embed into their platforms. For example, they can offer their customers such services as financial accounts for effective finance access, storage, and management. Or, this can be a flexible payment solution like Buy Now Pay Later when a buyer obtains a product in small installments.

When considering a BaaS platform, businesses should pay attention to its flexibility – how quickly and simply they can add/remove certain services. This way, it’ll be much easier for them to test their platform demand among their customers and swiftly adjust the financial services they provide to their customers’ preferences.

Those companies that are only considering adding BaaS solutions to their platforms have to take one more step in BaaS adoption – adjusting their platform to BaaS or building a new one from scratch.

Conclusion

BaaS is a relatively new notion in the banking and finance sphere that has already benefited a wide range of banks, non-financial organizations, and their customers. Therefore, many banks are considering developing their own BaaS platforms and many more online businesses consider integrating BaaS into their digital solutions. If you’re also thinking about implementing BaaS, our team of software development experts who have much expertise in FinTech development we will be glad to assist you. We have substantial experience in building complex BaaS solutions from scratch and integrating them into various digital platforms. Check out one of the recent cases on how SCAND helped one of its clients to develop a BaaS platform and don’t hesitate to contact us to build your own BaaS-powered platform.