How to Build a Fintech MVP in Banking and Finance

Building an MVP is a popular approach that many businesses follow when developing their own software applications. MVP allows them to quickly get into the market and provide an enhanced experience to their customers. Many companies use it as a viable strategy to get ahead of their rivals and ensure that they cater the most to their customers’ needs.

Banking and finance is a highly competitive sphere. Many companies strive to maximize their chances for success by turning to custom banking software development and creating their own FinTech solutions. In a highly competitive field time to market becomes a crucial factor that determines the success of such apps. That’s why banking and financial institutions also opt for the MVP building approach. Though, the most conservative among them still observe the implementation of MVP with a critical eye.

In this article, we’ll have a detailed look at MVP and discover why MVP Development for Fintech is an effective way for many banks and financial organizations to outperform in their market niche.

What is a Minimum Viable Product (MVP)?

A Minimum Viable Product (MVP) is a software development approach that involves a quick creation of a product with minimal functionality. Companies from various industries build their MVPs to ensure an early release of their product to the market and to quickly check if it will be popular among users and if it meets all their necessities.

MVPs are sometimes confused with prototypes but they have important differences. While a prototype is an experimental product version with one or several key features which shows the feasibility of technical requirements, MVP is:

- a complete product that contains all the key features that address major user requirements;

- sufficient and user-friendly for clients to utilize;

- meets all the quality standards expected in a completed version of the product;

- provides customer feedback for further product development.

Challenges and Solutions when Developing MVP in Banking

MVP development faces a two-fold attitude from banks and financial organizations. On the one hand, with MVPs companies can quickly develop their products and release them to the market fast, making improvements with each iteration. On the other hand, it involves rapid product change even if a development team is in the middle of building a particular feature for the requested app.

Companies with a traditional mindset find the implementation of rapid changes to be rather risky as conventional banking software development involves much stricter requirements for the final product. This involves full compliance with the legislation norms and standards of a particular country, straightened security demands, high accuracy when performing financial and banking operations, and much more. All these can’t be changed quickly and should be closely aligned with the constantly emerging product requirements.

Does it mean that it’s impossible to use MVP for building banking and finance solutions? The answer lies in the practical implementation of MVP for building banking solutions by many businesses:

- N26 CEO & Co-Founder Valentin Stalif in one of the interviews explained how their company utilizes the MVP approach to build banking FinTech solutions for their company.

- Lindsay Davis from Atomic Financial shared in Open Banking Rearchitecting the Financial Landscape research how their company used MVP for building their FinTech solution for neobanks during the Covid-19 pandemics.

- A banking lead, Lars Markull in his article on building MPVs in banking addresses the main concerns of building banking MVP and explains why this is a viable approach for banking app development.

What businesses should pay attention to when opting for MVP development for Fintech in banking? First of all, it’s a careful choice of software development partners. They should have solid experience in FinTech development to ensure that they align with all the strict requirements introduced by the banking sphere. The second is a thorough selection of the tech stack. The tech stack should provide a high level of source code security and opportunities to quickly scale the FinTech solution with the growing customer database.

Feature Set for MVP in Banking

When building an MVP for a banking app, businesses have to decide which features they should include in it first so that it provides maximum value. To define which functionality will have the highest impact, companies could start by studying the already existing banking solutions in the market. This will give them an overall view of the must-have features they need to include in their apps even if they create custom banking software.

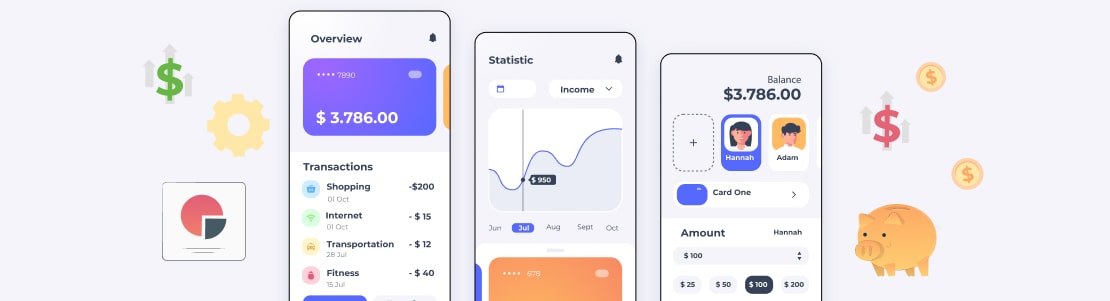

The most common functionality included into MVP of a banking app involves:

Customer application:

- registration;

- KYC;

- multi-factor authentication;

- profile management;

- accounts management;

- payment cards management;

- transaction history.

Back Office application:

- customers management;

- KYC process management;

- accounts management;

- transactions processing, history;

- settlements management;

- tariffs/fees management;

- exchange rates management;

- partners/providers management;

- analytics/revenue dashboard;

- reports generation;

- backoffice users management;

- role based access control;

- multi-factor authentication;

- customer support system;

- audit log.

When the set of features is defined, the next step is to range them by importance. For this, companies make a functionality short-list, ranging by importance, cost, and development time. This strategy helps them to determine the most valuable features they need to include in their apps.

Finally, after the app is launched to the market, businesses evaluate its success and gather user feedback. Based on this feedback, companies decide which functionality they should add to their apps next so that they’re best suited to the demands and expectations of their target audience.

Conclusion

Building an MVP in banking and finance is an effective way for businesses to quickly create and launch their product to the market as well as develop it in accordance with their customers’ expectations. Nevertheless, some banking organizations may be reluctant to implement the MVP approach as it also involves a quick change of requirements which is harder to achieve when building a finance-related digital solution.

A workable option that helps to overcome the bias of using MVP in banking is to search for a software development partner with extensive experience in FinTech development. Scand is a software development company with 20+ years of experience in the international FinTech market. It has delivered over 700 successful projects to its customers from different parts of the world and is ready to help you with your software development projects.