How to Create a Decentralized Exchange: Build Your Own DEX Platform

DeFi, or Decentralized Finance, is a broad notion that refers to financial services hosted on and supported by a blockchain.

They use cryptocurrencies to operate and eliminate intermediaries, such as financial institutions or governments, to conduct transactions.

Anyone with admission to a decentralized network, so is the thought, can borrow/lend money, get insurance, make worldwide payments, or earn on decentralized exchanges (DEX).

What Is DEX?

A decentralized exchange is a platform where people can trade cryptocurrencies among themselves without any interference from a bank, broker, or payment service of any kind.

It provides complete control over one’s budget by allowing users to buy and sell crypto in a completely automated manner.

All DEXs—like Hyperliquid, Raydium, or UniSwap—sit on three major components: blockchain technology, smart contracts, and compatible crypto wallets like Trust Wallet.

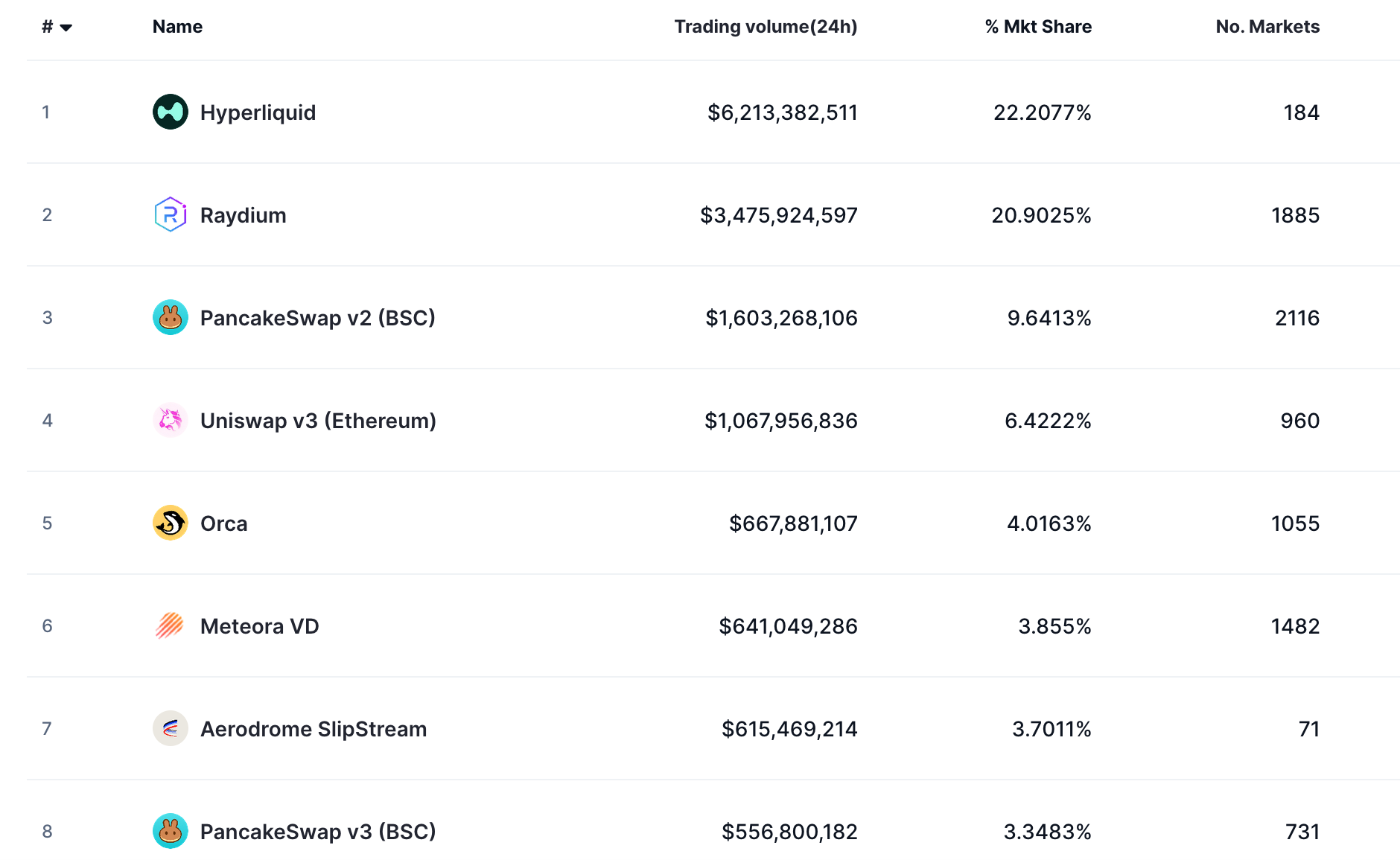

DEXs are booming. For example, the 24-hour trading volume of the Hyperliquid exchange platform comprises more than $4.5 billion, while the average daily trading volume across all DEXs is around $4.93 billion, up from $4 billion in 2023.

Top Cryptocurrency Decentralized Exchanges, CoinMarketCap

How Does DEX Work?

Unlike Coinbase or any other type of centralized exchange, DEXs do not let you trade between fiat and cryptocurrency. They will only let you swap one cryptocurrency for another. Still, a lot of DEXs also allow advanced trading options such as margin trading or placing limit orders.

Another important aspect is that, within the centralized exchanges, trading is maintained through an “order book,” calculating prices based on current buy and sell offers—very similar to stock markets like Nasdaq.

In contrast, decentralized exchanges depend on smart contracts. They use algorithms to set prices of cryptocurrencies, all while relying on so-called “liquidity pools” where investors can lock in money to earn rewards while helping drive trades.

While centralized exchanges record transactions in their own system, DEX transactions happen directly on the blockchain, making them more open and safe.

What Are the Potential Benefits of Building a DEX?

Creating a decentralized exchange platform offers much potential, especially when it comes to making money.

In contrast to centralized exchanges, DEX owners may generate revenue from a variety of sources: transaction fees, token listing, and LPs’ incentivization, plus governance tokens.

A DEX can also generate a considerable revenue stream by either introducing a native token or charging small fees on trades while still keeping the fees low for the users.

Another good thing about DEXs is that they’re resistant to censorship, meaning they’re more problematic to shut down or control. Anyone with online access and a crypto wallet can take part in trading, which is great for regions where classic banking is limited.

On top of that, DEXs often list a wider variety of tokens, including newer or less-known ones that might not be available on centralized exchanges, giving traders more chances to explore different projects.

What Steps Are Involved in Developing a Decentralized Exchange?

Most of the time, DEXs are made open-source, which means that any interested party can see exactly how they work. That also means developers can take pre-existing code and adapt it to build up new competing projects. But how is the creation process structured?

Getting Started and Setting Goals

If you want to create a DEX, you should start the process with preliminary planning and requirements groping, during which you will stipulate the features your DEX is going to have.

In particular, it involves deciding on the token to be supported, how the liquidity will be organized, and what kind of user experience you want to provide.

Developing the Front-End and User Interface

After planning, your efforts must be directed toward the frontend and user interface development. Your DEX is going to interact with real users, and thus, it needs to be user-friendly and easy to navigate.

Choosing the Right Blockchain for the DEX

Then, you will go for the selection of the right blockchain. The choice of blockchain will be the base of your DEX that will determine the speed of the transaction, its security, and fees.

While Ethereum is a standard choice for most people, you might consider other blockchains such as Binance Smart Chain or Solana if you want lower fees and fast processing time.

Setting Up Liquidity and Price-Setting Tools

Then, the setup of liquidity pools and AMMs has to be done. Liquidity pools are basically important in order to ensure that there is at least a decent amount of liquidity for trades to go through. AMMs themselves play a big role in setting prices based on market supply and demand.

You shall decide on the architecture of such pools and the imposition of AMMs so that the trading process remains easygoing.

Delegating the Project

If you plan to get a high-performing DEX but lack the in-house expertise, you can delegate the development project to a software development company, such as SCAND.

Working with experienced blockchain developers who specialize in cryptocurrency exchange development can ensure your DEX is built with robust security, flawless wallet integration, and scalability in mind.

A trusted development company can also implement new features, provide 24/7 assistance, and monitor your DEX to adjust to any market conditions and user demands.

Creating Smart Contracts

Then comes the work on smart contract development. Smart contracts are the backbone of your DEX, as they independently execute transactions and regulate all critical operations without a middleman.

Writing proper contracts and testing them for glitches or vulnerabilities is important in demonstrating your platform or users will not be exposed to risks.

Testing and Security Reviews

Testing and security audits are the next step. Before launching, every part of the platform—smart contracts, UI, and overall functionality—has to be tested.

Security audits are of high importance to recognize and resolve any kind of vulnerabilities that may jeopardize user funds or the integrity of the platform in general.

Going Live and Monitoring Your DEX

After all testing is complete and the security is on point, it’s time to roll out your DEX and begin monitoring. A launch indicates the beginning of operation for your online platform, but in fact, this is where the real work begins since further regular updates and monitoring are needed to ensure the DEX stays on top of its performance.

How Can You Ensure Security in Your DEX Platform?

Security cannot be compromised for any DEX. With no central authority to step in if something goes wrong, users are fully responsible for protecting their funds. Some common vulnerabilities in the DEX platform include:

- Flash loan attacks

- Front-running attacks

- Reentrancy attacks

- Insufficient liquidity

To stay safe, use hardware wallets because they store private keys offline, making them much harder to compromise. For those using software wallets, in turn, it’s important to set up a strong, unique password and enable two-factor authentication functionality to add extra protection.

There are many phishing schemes in the crypto space, so users must be vigilant. Phishing implies deceiving people into providing wallet information by creating fake sites or messages.

That’s why it’s important to provide clear warnings and safety tips to help your target audience spot and avoid these scams.

Another strong security measure is multi-signature wallets, which require several approvals before the transaction goes through. This will make it really hard for hackers to steal funds, especially in businesses or high-value accounts.

One more necessity is recovery phrase backup. If a user loses access to a wallet, the backup—ideally stored offline—is assurance that they don’t lose the funds forever.

Encryption also plays a prominent role when you build a decentralized exchange—if a hacker gets access to a user’s device, encryption helps guarantee they can’t steal private keys or personal data.

Factors That Influence the Success of a Decentralized Crypto Exchange

The success of a decentralized exchange of cryptocurrency relies on a mix of factors that make or break its capability to compete with other platforms.

The most significant of these is liquidity. Without sufficient assets to trade, users will be dissatisfied with delayed transactions and bad prices, and they will move to more established platforms.

To avoid this, successful DEXs team up with liquidity providers, use automated market makers, or offer rewards to stimulate users to supply liquidity. Without a steady flow of assets, even the most advanced platform won’t stand a chance.

Of course, the most successful platforms keep things simple, offering a clean interface, fast transactions, and easy wallet connections.

Because DEXs lack the typical customer support of centralized exchanges, customers must be able to navigate the platform independently. The more user-oriented and beginner-friendly the experience, the better.

In addition, transparency goes a long way—users like to see open-source code, transparent governance models, and a healthy, active community supporting the platform. When individuals trust a DEX, they’re also more likely to remain active and trade there.

But security isn’t the only thing that keeps a DEX relevant—the crypto space moves fast, and platforms that adapt to new developments—like layer-2 scaling, cross-chain trading, or unique DeFi functionality—have a much better shot at long-term success.

DEXs that bring something fresh to the table, such as lower gas fees or exclusive liquidity solutions, possess a significant advantage over rivals.

How Do You Build a DEX That Competes with Established Platforms like Uniswap?

It is not simple to beat the giants like Uniswap, but if you play your cards right, then your DEX can get a reputation as well. The secret is to stand out by providing something that others are not.

Maybe it’s lower fees, exclusive token listings, or professional-grade trading tools—whatever it may be, you must have something that would make individuals willing to make the change. If your platform feels just like every other DEX out there, it’s going to be tough to get traction.

Yet good features alone are not sufficient if no one is aware of them. That is where clever marketing steps in. Referral programs, token incentives, and partnerships with other DeFi projects can be used to attract traders and liquidity providers.

Other than that, social media and influencer collaborations can provide your platform with the buzz it deserves. The more individuals hear about your DEX, the more eager they’ll be to test it out.

And let’s not forget to stay ahead of DeFi trends—if you integrate yield farming, staking, or governance tokens, you’ll give users more reasons to stick around.

Traders are constantly searching for the latest and greatest, so if your DEX offers fresh, exciting features, it has a much better shot at gaining long-term traction.

What Are the Challenges in Creating a Decentralized Exchange?

Building a successful DEX isn’t always a piece of cake. From technical roadblocks of blockchain development to regulatory headaches and tough competition, there’s a lot to figure out.

First, the tech side of things can get pretty complicated. DEXs rely on smart contracts, which means any bugs or vulnerabilities can lead to serious security risks. On top of that, issues like slow transactions, high gas fees, and network congestion can frustrate users if they’re not handled properly.

That’s why having a well-equipped development team and a strategic tech stack is a must. You need to make sure your platform runs equally well whatever the conditions are, stays secure, and can scale as more users join.

Then, there’s the whole regulatory gray area. While DEXs don’t have a central authority, that doesn’t mean they’re completely off the radar.

Governments are still negotiating how to regulate crypto trading, and new rules could pop up at any time. Staying informed and making sure your platform doesn’t run into legal trouble is key to avoiding any major headaches down the road.

And of course, there’s competition. The DeFi space is packed with new platforms that are launching all the time, which means standing out is a problem. Offering low fees, strong liquidity incentives, and unique features can help, but it doesn’t stop there.

Keeping users engaged with a smooth experience, continuous updates, and strong community support is what really makes a difference in the long run.

Frequently Asked Questions (FAQs)

What is a decentralized exchange, and how does it differ from other exchanges?

A decentralized exchange allows users to trade directly with one another without the presence of a centralized authority. DEXs provide greater control over assets, better privacy, and lower vulnerability to hacking compared to traditional exchanges.

What are the major elements required for decentralized exchange development?

The major elements for exchange development are blockchain infrastructure, smart contracts, liquidity pools, and automated market makers (AMMs). Together, they form a decentralized and automated trading ecosystem.

How do smart contracts work in a decentralized exchange?

Smart contracts facilitate trustless, automated user-to-user transactions. Smart contracts carry out trades, manage liquidity, and perform other processes on the DEX without using intermediaries.

What steps are involved in the DEX development process?

The steps in the development process include planning and requirement gathering, selecting the appropriate blockchain, incorporating liquidity pools and AMMs, and securing the platform.

How can I create a decentralized exchange that attracts liquidity providers?

Incentivize liquidity providers with competitive rewards, e.g., a share of transaction fees or preferential token listings. A sound liquidity model and the ability to list a large number of tokens can also attract providers to your platform.