How to Build a Triangular Arbitrage Bot for Crypto Markets

After the results of the US elections in late 2024 and pro-crypto appointments in key government positions, the prices of several cryptocurrencies substantially increased.

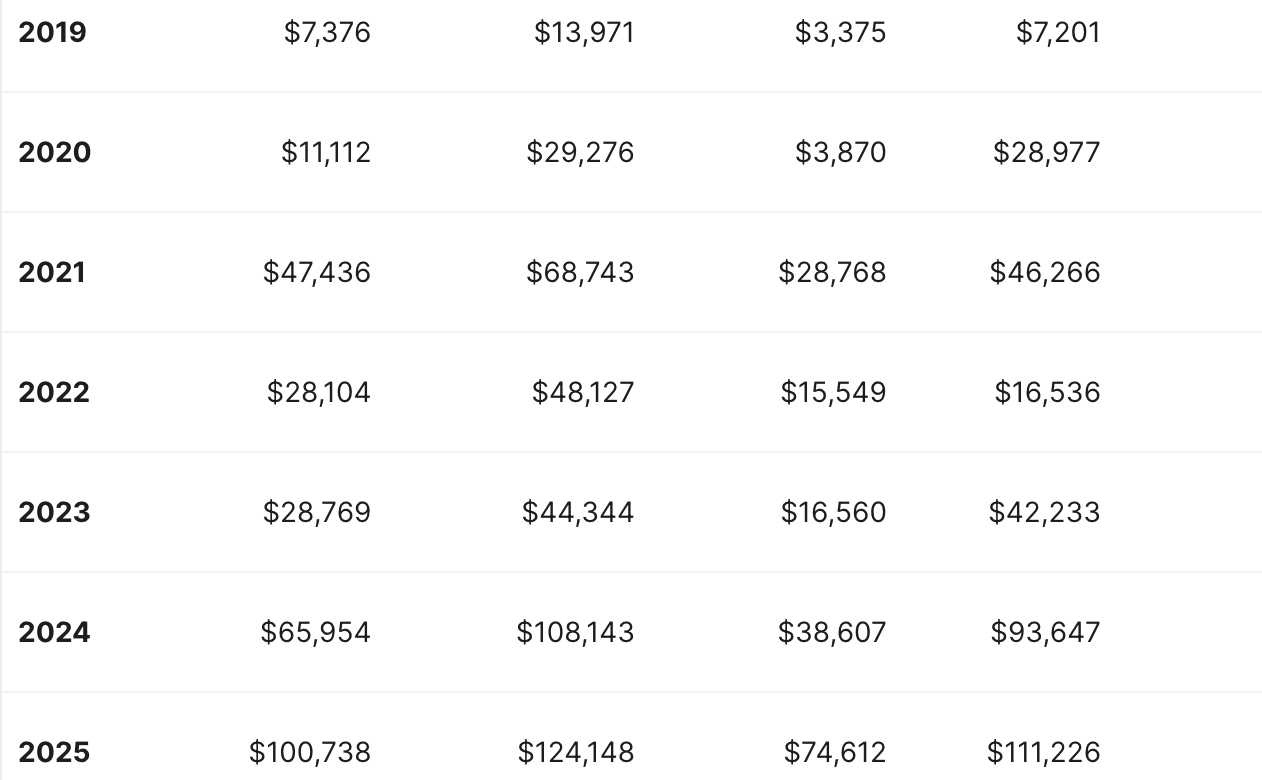

The price of Bitcoin, for example, reached $108,143 in 2024, although its peak in 2023 was only $44,344.

However, the crypto market never stands still — what was worth tens of thousands of dollars yesterday may be worth just a few dozen today or may completely disappear into oblivion.

Because of this constant volatility, crypto trading and arbitrage strategies often feel like a guessing game, with traders waiting for the right moment and second-guessing if their predictions will actually pay off.

In such an environment, success often depends on speed: the ability to recognize and act on opportunities in just milliseconds. One such strategy traders and developers have been experimenting with lately is triangular arbitrage.

Historical Prices of Bitcoin by Years, Coinlore

The values are arranged in the following order: Price → Max Price → Min Price → Close.

What Is a Triangular Arbitrage Bot?

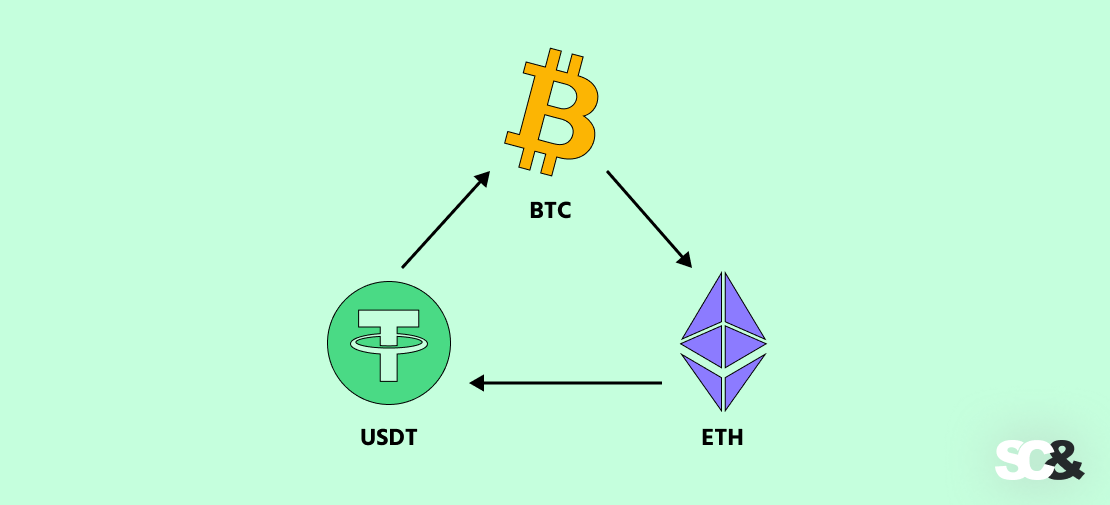

A triangular arbitrage trading bot is software that automatically finds and makes quick trades between three different currency pairs on the blockchain (e.g., BTC, ETH, USDT) to take advantage of small price differences.

Here’s the idea:

- A trader starts with one coin, such as BTC.

- The bot then trades BTC for ETH.

- After that, it trades ETH for USDT.

- Finally, it trades USDT back into the original BTC.

The Idea Behind a Triangular Trading Bot

If the cycle ends with more BTC than the trader started (after fees), the bot has made a profit.

This benefit extraction is made possible by the fact that crypto markets are fragmented across exchanges, and prices frequently deviate. Yet, these prospects usually last only a fraction of a second, and without the help of a bot, it would be almost impossible for a trader to earn on market inefficiencies.

How a Bot Works: Popular Triangular Arbitrage Strategies

Triangular crypto arbitrage bots can be used in many ways, depending on the platform and the manner in which traders want to trade.

1. On One Crypto Exchange

This is the most common setup and usually the easiest to govern: the bot looks for price misalignments between all pairings available (e.g., BTC/ETH, ETH/USDT, BTC/USDT) on the same exchange.

As all the trades are being done within one spot, the traders do not need to move money from one point to another, and thus the trades can be executed very quickly.

Example: If 1 BTC → 15 ETH, 15 ETH → 30,500 USDT, and 30,500 USDT → 1.01 BTC, the trader ends up with a 1% profit cycle.

2. On Multiple Exchanges

Bots can also operate between two or more platforms, taking advantage of liquidity gaps: if, let’s say, ETH is cheaper on Exchange A and pricier on Exchange B, the bot can buy low on one and sell high on the other platform.

Despite all its apparent simplicity, moving funds between exchanges can eat into profits. To get around this, many traders pre-fund accounts on several markets so trades can be made on time.

Example: If ETH is $2,010 on Exchange A and $2,020 on Exchange B, the bot can capture the $10 spread per coin.

3. In DeFi (Decentralized Finance)

Decentralized exchanges (DEXs), such as Uniswap, SushiSwap, or Curve, offer another playground for arbitrage bots: because DEX prices are set by liquidity pools and automated market makers (AMMs), price slippage between pools often creates arbitrage opportunities.

Also, bots in DeFi can use flash loans, which let traders borrow large amounts of crypto without collateral, as long as the loan is repaid in the same transaction. This allows arbitrage with almost no upfront capital.

Example: A bot could borrow 1,000 ETH via a flash loan, run a three-step arbitrage trade across pools, instantly repay the loan, and keep the leftover profit.

Benefits of a Crypto Triangular Arbitrage Bot

According to the research, some kinds of triangle arbitrage strategies accounted for around 2.71% of all trades on Binance. But why do more and more traders opt for triangular arbitrage cryptocurrency trading?

One of the biggest advantages of using a triangular arbitrage crypto bot is its ability to automate trading and work at incredible speed and accuracy.

At the same time, it removes the emotional side of trading. Unlike human traders, who may hesitate or act on fear and greed, the crypto trading bot relies purely on logic and predefined conditions.

Another important benefit is that the bot never rests. Crypto markets run non-stop, and while no person can stay alert around the clock, a bot can monitor markets 24/7 and take advantage of fleeting opportunities at any time of the day or night.

Finally, triangular arbitrage is often considered a relatively low-risk approach compared to regular trading, because it doesn’t depend on whether a coin’s price goes up or down.

Instead, the bot simply exploits temporary mismatches between currency pairs. While fees, slippage, and market competition can still affect results, a well-designed bot can help traders capture profits with less exposure to traditional market risks.

Essential Components & Architecture

A crypto triangular arbitrage bot isn’t just a simple script that trades — it’s a system made up of several components that work together to spot opportunities and act on them fast.

- Market Data Collection: The bot needs a constant stream of live market data to function. It attaches itself to exchange websockets or APIs to receive order book information and prices in real time.

- Opportunity Detection: This module checks thousands of possible three-currency loops and calculates if going through them will bring a profit after commission fees. As an example, it might attempt BTC → ETH → USDT → BTC and see if you have more BTC than when you started. To conserve time, the bot can be set to disregard feeble signals, for instance, anything with less than a 0.2% profit margin.

- Execution Engine: When a profitable opportunity is found, the bot needs to respond to it. The execution engine carries out trades in the proper order as fast as possible. Some programmers even colocate their bots next to exchange servers in order to reduce lag, as a matter of a few milliseconds might result in profit or loss.

- Risk Management: Not every chance needs to be taken. Fees, illiquidity, or wild price fluctuations can turn a “profitable” trade into a loss. The risk management module double-checks every trade and prevents it from being executed if there isn’t enough liquidity or prices exceed a specified tolerance.

- Monitoring & Logging: All bot activities should be recorded: time of trade, profit/loss, fees, and errors. Such vigilance allows for performance tracking and can display results or spot problems, such as a high failed trade rate.

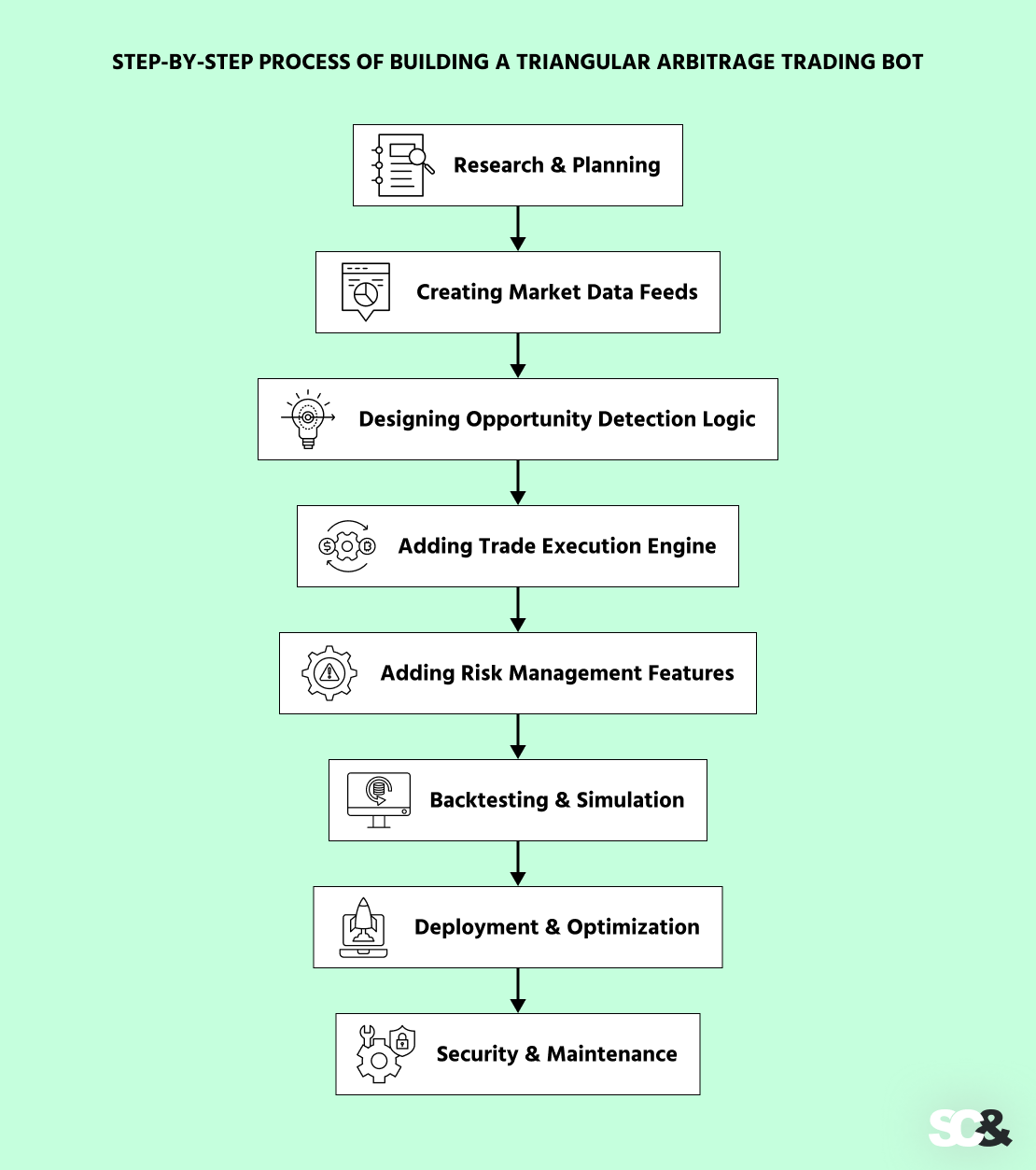

Step-by-Step Development Guide

Building a crypto trading bot is always a step-by-step process. While each developer or team may do it a bit differently, this is what usually happens:

1. Research & Planning

Planning always comes first before coding. Stakeholders usually decide which exchanges to enter, which pairs to focus on, and what profit margins to target. For example, some developers may focus on liquid pairs like BTC, ETH, and USDT, but others may include smaller tokens if they have more appealing arbitrage spreads.

2. Creating Market Data Feeds

The next step involves connecting to exchanges through APIs or websockets that allow the bot to get live price feeds. Since arbitrage opportunities are fleeting, developers use exchanges with good, low-latency data feeds.

3. Designing Opportunity Detection Logic

When data is flowing, programmers develop algorithms that find possible triangular loops and calculate potential profits after commission. This step also involves adding rules to omit cycles too tiny to be worth trading.

4. Adding Trade Execution Engine

Here, programmers create a module that can submit and carry out trades one at a time, typically employing asynchronous programming to place multiple orders without losing time.

5. Adding Risk Management Features

Even the best prospects can fizzle due to slippage or liquidity. Therefore, developers add an inherent risk filter into the conditions checked by the bot before each trade.

6. Backtesting & Simulation

Before going live, the bot is generally tested on historical data or run in simulation mode with live data but without actually performing trades. Overall, software testing confirms that the detection logic works as needed and that the execution engine can tolerate any market conditions.

7. Deployment & Optimization

After testing, the bot is deployed to run live. But normally, this is not all. Over time, developers typically work on improving the detection logic, modifying profit boundaries, and adjusting performance.

8. Security & Maintenance

Finally, the bot is hardened for secure, long-term use. Developers safeguard API keys, set up access privileges, and apply regular updates to remain in sync with exchange API changes.

Step-by-Step Process of Building a Triangular Arbitrage Trading Bot

To get a head start and reduce development time, you can use tools like SCAND’s Bot Starter Kit, which provides ready-made frameworks and components for making crypto trading bots way faster. It’s a great way to focus on strategy rather than starting entirely from scratch.

Challenges & Risk Factors

While triangular arbitrage crypto bots in appearance can be lucrative, they are fraught with challenges. One of the biggest is competition — a great many other bots look at the same markets at the same time. By the time your bot tries to act, the opportunity may already be gone.

Transaction cost is an equally important consideration. Because the arbitrage profits are usually so small, fees or slippage can quickly turn a winning trade into a loser. That’s why the bot always has to calculate net profit before it does a trade.

Latency is no less important. Opportunities do not last longer than milliseconds, and even tiny delays in receiving price updates or submitting orders can eliminate potential profits.

Exchanges also carry risks. Outages, withdrawal restrictions, or API throttling can cause trades to be cut off in mid-cycle. If one leg of the trade falls through, the bot might find itself with an undesirable position.

In practice, all this means is that while a bot may find thousands of potential opportunities in a day, only a handful of them actually become profitable after adjusting for fees, slippage, and the risks of execution.

Future Trends & Advanced Trading Strategies

In the future, traditional triangular arbitrage bots, which now scan thousands of currency combinations using brute-force methods, will barely keep up with faster and more competitive markets. AI-driven methods are going to change this.

For instance, one of the expected innovations will be Graph Neural Networks (GNNs), which will treat exchanges and currency pairs as a network of connected points, allowing bots to spot profitable triangular cycles in real time.

GNN-powered bots will be able to quickly filter out trades that aren’t worth executing and adapt to changing market conditions, giving them a clear advantage over older methods.

Another trend will be reinforcement learning that, together with GNNs, will define the next generation of bots. As expected, these bots will not only react to the market but will also learn and anticipate profitable cycles, becoming faster and smarter than ever before.

Frequently Asked Questions (FAQs)

What makes triangular arbitrage different from regular arbitrage?

Regular arbitrage looks for price differences between two markets, while triangular arbitrage finds differences between three currency pairs, usually within one exchange or between exchanges.

How much capital do I need?

You can start small (roughly $100 to test), but to have a large profit, you'll usually need $10,000 or more to have enough liquidity for transactions.

Which exchanges are best for triangular arbitrage?

High-liquidity exchanges with low fees are ideal. Popular choices include Binance, Kraken, and KuCoin.

Is triangular arbitrage still profitable in 2025?

Yes, but competition is tough. Success depends on optimizing your bot, reducing delays, and managing fees carefully.

How do fees and slippage affect profits?

Modest gains are typically eaten up by fees and slippage. Yet, a good bot always factors in trading fees, network fees, and price movements before it places a trade. Want to make the most of cryptocurrency market gaps? Team up with SCAND, and we’ll help you build a custom triangular arbitrage bot to catch opportunities as they happen.