Crypto Grid Trading Bot Development: How to Create and Optimize Your Bot

The ascent of algorithmic trading has altered the cryptocurrency commerce field, granting traders the liberty to automatize their strategies with utmost accuracy. Now, determining to craft a crypto grid trading bot development would be one of your most proficient expeditions for capitalizing on market fluctuations. This guide explores the fundamentals of grid trading bots, their design, & optimization road maps.

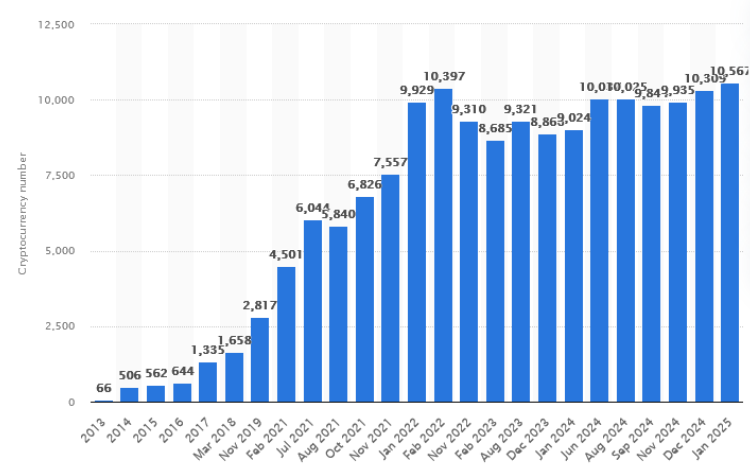

Amount of crypto coinage around the globe, 2013-beginning of 2025, Statista

What is a Crypto Grid Trading Bot?

Starting straight away, let’s unmask the topic’s geometry. A crypto futures grid trading bot is an automated trading instrument which places buy & sell placements at predetermined price layers within a trading extent. By seizing the cryptocurrency market trends, it trades persistently. Spawning earnings from price fluctuations is the dominant target.

Hence, it can sell orders at specific prices to adapt to changing market conditions.

Overview of Grid Trading in Cryptocurrency

More in-depth, grid trading is a mechanic that splits a settled price range into multiple levels, creating a grid of buy & sell orders. The scheme is relevant in unpredictable and different market directions, where prices fluctuate within a set range, providing a stable income from small price fluctuations.

How Grid Trading Bots Simplify Crypto Trading

Therefore, grid trading bots robotize these techniques, neutralizing the exigency for hands-up order placement. In short, the techniques fasten up crypto trading bot strategies via profit from current market price moves:

- Escaping human mistakes with its’ grid of orders

- Carry out trades non-stop—24/7

- Swift market swings’ reaction

- Demote emotional trading verdict

- Adjusting the grid

Crypto Grid Trading Bot Development: How to Create and Optimize Your Bot

Diving into the crypto grid trading bot development process, let’s disclose the specialties of its saturated menu and the market avengers.

Why Choose Grid Trading Bot Development?

Developing a grid trading bot boosts a company with unseen trading perks & bonuses. Whether for personalized utilization or applied as a commercial app, a well-crafted trading app might noticeably intensify trading productiveness & simplicity. Taking advantage of market fluctuations, it pulls profit from small price fluctuations by buying according to price differences between different market moves.

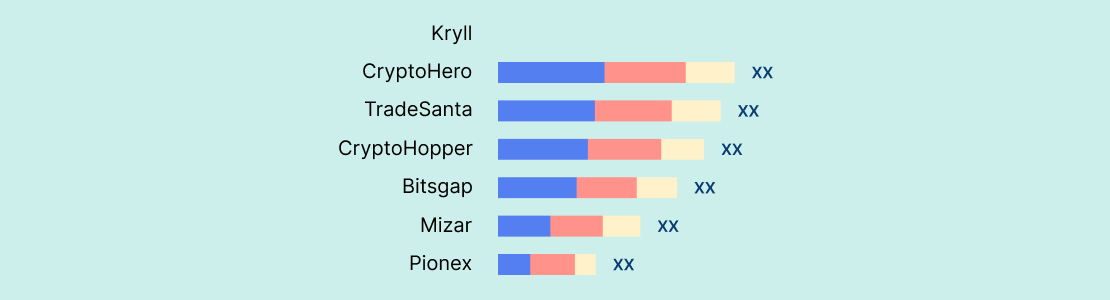

Plunging into the world of crypto trading, the following products emerge as the top hitters:

Plunging into the world of crypto trading, the following products emerge as the top hitters:

Dominant players of the crypto trading domain, February 2025, Marketresearchintellect

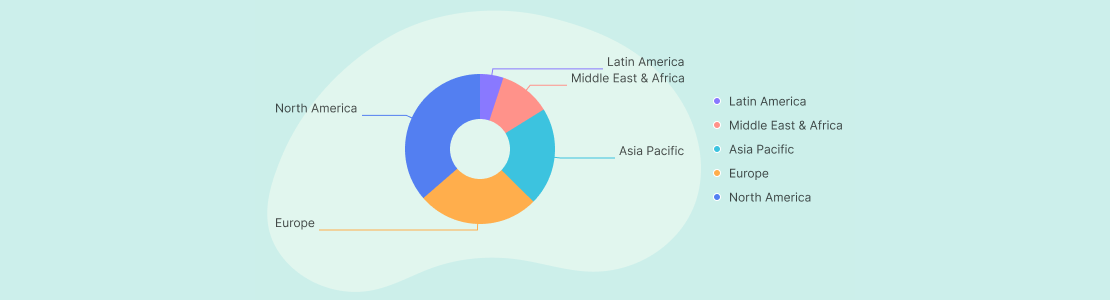

The development locations are like below:

Crypto trading bots’ development mart geography, February 2025, Marketresearchintellect

Benefits of Developing a Grid Trading Bot for Cryptocurrency

As the crypto grid trading bot development boons, capture the upsides listed to help your company amplify:

- Automatized trading decisions for passive earnings

- Swifter trade when opposed to trading by hand

- Administering various trading pairs concomitantly

- Diminishing trading perils via systematized accomplishment

Key Features of a Well-Designed Grid Bot

A thoroughly performing grid trading bot should obtain attributes to witness data shielding & expediency. Therefore, these components shall bump up as centerpiece pieces of a carefully calibrated grid trading app, potent to take advantage of price fluctuations:

- Adaptability in grid spacing: with it, traders own the liberty to adapt grid levels vigorously based on the mart behavior, placing optimal buy & vend placements.

- Halt loss & catch profit mechanics: it governs market perils automatically by tracing thresholds. So, you can escape losing trades & blocking in profits at predefined tiers.

- Constant market inspection: with the assistance of embedded AI & ML procedures, this tool scans historical trends & market feelings to amend judgments.

- Many-notes exchange possibility: it witnesses multiple cryptocurrency swaps, granting traders power for extended market access & multiplied chances for sales.

- Automated operation and placing deals: with uninterrupted, swift, & carrying orders thoroughly, traders’ productivity ameliorates, generating profits.

- Backtesting & imitation: it’s where traders can proof-test the grid trading procedures in fake environments before going actual, guaranteeing threats’ minimization.

- Vigorous features for risk management: with trailing halt losses & grid rebalancing, it’s simple to acclimate as the market fluctuates.

- User-friendly layout: it grants intuitive dashboards with visualization instruments, making traders potent to govern operations & establish preferences.

- Security & compliancy: this trick implements encryption, API key protection, & compliance yardsticks for keeping user funds safe & for regulatory adjustment.

- Reminders & alerts: it keeps traders updated with market behavior, backing up a bot with actual alerts & notices.

Why Work with a Grid Trading Bot Development Company?

Professional developers provide:

- Advanced AI and ML integration

- API integration with major crypto swaps

- Security advancements to evade exploits

- Constant assistance and optimization

How to Create a Crypto Grid Trading Bot?

So, approaching the essence of the blog, let’s answer the major question of the article—how to create a crypto trading bot?

Added to this statement, there is some historical data by Statista as to the cryptocurrencies’ fluctuations and prospects.

Cryptocurrencies’ price movements, January 30, 2025, in $ U.S., Statista

Observe several overriding crypto grid trading apps to take as a favorable illustration for your crypto grid trading strategy:

- Pionex boasts decreased trading fees & 16 free trading bots.

- Bitsgap with manifold-swap support (Binance, Kraken, KuCoin).

- Binance Grid Trading Bot, fitting for high-frequency users & featuring Binance Futures incorporation.

Essential Steps in Grid Bot Development

- Define trading traits. It implies selecting grid spacing & halting losses.

- Developing a trading scheme involves operating the logic for an automatized buy/sell procedure.

- Embed APIs, relating the bot to cryptocurrency swaps.

- Implement a methodology, witnessing that the bot acts within shielded trading boundaries.

- Check your bot in artificial settings: it ameliorates productivity before live deployment.

Choosing the Right Tools and Technologies for Development

- Programming languages encompass: Python and JavaScript, with C++ for back-end logic on board.

- Exchange APIs: Binance, Coinbase, Kraken, etc.

- Administering databases: for keeping trading data in repositories.

- ML: TensorFlow or PyTorch—for predictive assessment.

Implementing the Grid Strategy for Efficient Trading

Moving further, let’s gaze into the next development tier:

- Firstly, establish a price array by dividing it into grid levels.

- Secondly, locate your buy orders in the bot at predefined grid inferior layers.

- Thirdly, locate sell orders in the bot at predetermined inflated layers.

- Lastly, adapt grid layers to an unpredictable degree, as per the market situation.

Advanced Features for a Successful Crypto Grid Trading Bot

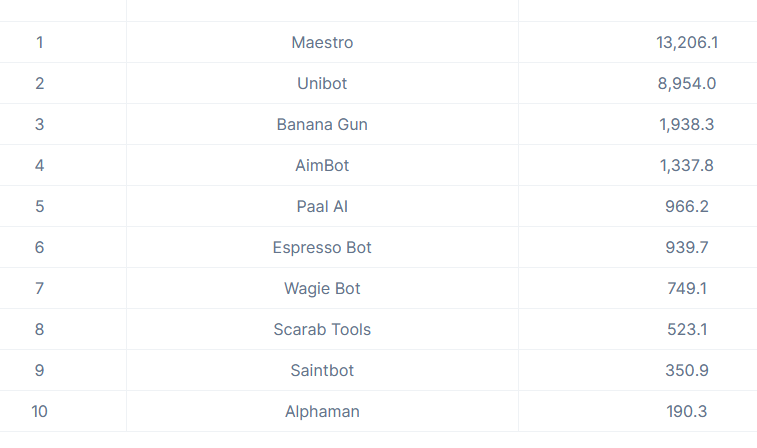

Polishing your crypto grid trading bot with sophisticated features promises your business bettered decisional processes & user records’ safety. Look now at the most progressive bots in the domain to grasp motivation & pull advantage of price differences:

Champions in bots domain, December 2023, Coingecko

Now, look at the progressive enhancements to consider turning your crypto grid trading bot development into a tornado of boons.

Automated Market Analysis and Decision-Making

- AI-powered trading vision: here, machine learning models examine historical and real-time records to pinpoint favorable trading routes.

- Sentiment examination: the feature employs natural language processing (NLP) mechanics to pull market behavior from news, social networks, etc.

- Adaptive trading strategies: with this piece introduced, your bot sets the grid settings based on market trends.

Integration of Stop Loss and Take Profit Mechanisms

- Tracing stop-loss adapts to stop-loss layers with the asset price shifting in a positive course. This move extremely stokes your profits with reduced losses.

- Take-profit tiers grant steady profit by being locked in by setting predetermined points.

- Stop-loss mechanisms enable dealers to apply market volatility pointers to fix optimal limits.

Customization Options for User Preferences

- Elastic grid acclimation is where traders independently fine-tune grid distance & place orders for diversified market behavior.

- Multi-asset backup grants trading possibilities within multiple crypto coinage scattering & trading pairs concomitantly.

- Peril governance settings established by traders—this promising tip permits agents to configure the spot sizing, leverage, & loss alleviation routes.

- Real-live reminders & alerts—upgrades are sent to users on market behavior, performed trades, & current metrics via in-app reminders, etc.

- By embedding these heavy-weight progressive features into your crypto grid trading bot, deliver a highly operative, adaptable, & safety-boosted solution.

How to Optimize Your Grid Trading Bot for Crypto Markets?

Moving closer to the final stage of our storyline, let’s reflect on augmenting productivity with progressive AI components. Don’t overlook the stage!

Adjusting Grid Levels for Market Volatility

Let’s now see more powerful methods to turn your crypto grid trading app into a cash-bringing tornado.

- Changeable grid modifications. So, set grid levels that expand based on real-time market volatility, reducing fragility to sudden price alterations.

- AI-based prognosis. This piece avails from ML & dives into historical records to present optimal grid width based on recent drifts.

- Adaptive trading ranges. Here, you’re advised to invoke robotized adjustments to the trading according to price shifts and conserve the strategy.

Optimizing Buy and Sell Orders to Maximize Profit

Regarding more solid profit augmentation, here are advanced tricks to facilitate the crypto grid trading bot development.

- Smart order fulfillment. Now, choose to exploit algorithms modifying buy-&-sell commands in a changeable manner.

- Slippage governance. Challenge up to shrink the price slippage, implying placing limited orders, not market orders. It promises more detailed execution.

- Rationalizing fees. Adjust trade sizes & regularity to decrease transaction charges, increasing net revenues progressively.

Continuous Monitoring and Performance Evaluation

With this final touch, adjust to more uninterrupted surveillance of the profitable crypto grid trading bot:

- Tracing real-live execution. Enact instrument panels with live analytics on trade victory ratio, market behavior, & profit boundaries.

- Backtesting methods & approaches. Here, constantly test miscellaneous grid shapes in artificial settings.

- Automatically reporting performance. This last feature scans trades held & suggests refinements, certifying running amelioration of trading routes.

By applying these optimization avenues, traders will maximize profitableness by risk mitigation, keeping grid trading bots rivalrous in financial markets.

Why Partner with a Grid Trading Bot Development Company?

As we approach the last stretch of the road on our voyage across the crypto grid trading bot development, may we authorize ourselves to present you SCAND, a solid software company with long-standing expertise & an expert crew.

Inevitably, designating an expert team for development enhances your bot’s productiveness & its data security. So, draw near & carefully consider some insights.

SCAND’s Expertise in Crypto Grid Bot Development

Sophisticated developers clearly comprehend all algorithmic trading’s specificities and provide robust coding, AI integration, & optimization services.

Like here, SCAND’s skillfulness reaches far, presenting cutting-edge skills & craftsmanship to make businesses shine.

Tailored Solutions for Different Trading Needs

A custom-built bot can victual to specific trading routes & risk tiers, crafting fruitful bonuses and perks.

To help you succeed, SCAND delivers crypto trading services like:

- Integration services for arbitrage bots

- Tailored crypto arbitrage bot solutions

- Embedding Bot-as-a-Service

- Pro consulting for your arbitrage needs

Ongoing Support and Maintenance for Your Bot

Uninterrupted support ascertains security updates, bug mends, & breakthroughs, keeping your bot prompt in changeable market fluctuations.

Challenges in Crypto Grid Trading Bot Development

As a finishing round, crypto grid trading bot development emerges with some obstacles. These glitches claim for exact planning, grounded tech expertise, & risk tolerance methodology.

Catch on some of the pressing constraints getting on the road of crafting your crypto grid trading bot. Hereby, memorize how to tackle them:

Addressing Technical Issues During Development

- API integration complexities. Guaranteeing well-performed connectivity with crypto exchanges can be strenuous due to diverging API structures & rate limitations.

- Retardations & productiveness rapidity. Bots must execute trades online to grow on market fluctuations, requiring prompt code optimization.

- Thoroughness of algorithms. Developing an unbreakable trading routine effectively following the grid strategy without excessive leakages.

- Scalability hiccups. As trading capacity expands, guarantee the bot runs large datasets & executes placements efficiently.

Managing Risks Associated with Grid Trading

- Market changeability. Sudden price shifts can break the grid strategy, causing unintended leakages. Implementing AI-driven volatility detection helps escape risks.

- Overtrading & fees. If a bot executes deals, transaction charges might affect income.

- Liquidity hiccups. Low flowability in some trading pairs turns into slippage.

- Unpredictable market clashes. Rapid market downturns execute multiple buy placements without corresponding vending opportunities, rooting capital lock-up.

Ensuring Security and Compatibility

- Cyber dangers. Encrypting, API key protection, & secure authentication mechanisms are pressing.

- Regulatory adherence. With an ample stack of jurisdictions in trading, try to comply with the frameworks.

- Data privacy. Safeguarding user records & trading strategies remain confidential is constitutive for safeguarding traders’ reliance.

- Preventing exploits. Finally, implementing security audits & testing mechanisms to escape loopholes & unauthorized entry.

How to Get Started with Crypto Grid Trading Bot Development?

Terrified about launching a brand-new app? Worry not, as a carefully packed grid trading bot requires a structured methodology. Just stay placid & read further.

Steps to Launch Your Own Grid Bot

- Define objectives & strategy. Determine the trading goals, preferred pairs, risk allowance, & market sentiment that your bot performs with.

- Select the suitable development instruments. Select the fitting programming languages (e.g., Python, JavaScript), frameworks, & APIs harmonizing with the bot’s requirements.

- Develop the basic trading algorithm. Carry the grid trading routine, incorporating parameters like grid spacing & trade execution logic.

- Integrate with cryptocurrency swaps. Tie the bot with switches like Binance, Kraken, & Coinbase via API integration.

- Carry out features to govern threats. Dynamic stop-loss & trailing stop-loss orders to shield data against extra losses.

- Test in artificial environments. Run backtesting with historical records & paper trading in live conditions to refine the bot before real deployment.

- Optimize for expediency. Examine bot performance, adjust parameters based on market behavior & incorporate AI-powered tricks for smarter trading verdicts.

- Back up data safeguarding & compliance with guidelines. Implement encryption and secure API key storage, by complying with regulatory guidelines to shield user funds & records.

- Deploy and monitor live trading. Launch the bot with a controlled capital allocation, continuously track its progress & produce modifications for optimal results.

- Provide constant support & upgrades. Steadily update the bot with market refreshments for security updates, profitability, & feature modifications.

Selecting the Right Development Team

Cooperating with experienced blockchain engineers guarantees the bot meets performance, safety, & compliance guidelines.

Key Considerations for Long-Term Success

- Regular software add-ups

- AI-powered ameliorations

- Optimizing productivity

- Records safety

- Robust risk governance

- UI & customization

- Overarching backtesting & live testing

- Customer support & community inclusion