Ethereum Arbitrage Bot Development: How to Build a Profitable Trading Bot in 2025

Arbitrage continues to be one of the most straightforward yet most competitive methods of making profits in financial markets, and the same applies to the crypto market.

With thousands of tokens and regular fluctuations in supply and demand, the opportunities for promising deals not only persist but are actually increasing in 2025.

Ethereum has always been one of the most important ecosystems for arbitrage owing to its high liquidity, extensive network of decentralized exchanges (DEXs), and highly active developer community.

But is Ethereum still worth joining for arbitrage purposes? The short answer: yes. Although the market has toughened, the development of Layer 2 (L2) protocols, cross-chain bridges, and custom-made arbitrage bots continues to provide new avenues for traders and businesses wanting to earn on market inefficiencies.

Some Facts on Ethereum Ecosystem Trading Activity

- In March 2025, Ethereum’s DEXs recorded a trading volume of $63 billion, leading the market.

- Ethereum runs around 1.6 million transactions per day, with smart contract interactions accounting for nearly 62% of all daily transactions.

- In March 2024, Ethereum’s Dencun hard fork introduced EIP‑4844, cutting Layer 2 transaction costs by up to 90%.

What Is an Ethereum Arbitrage Bot?

Blockchain arbitrage is explained as the act of taking advantage of price discrepancies of the same asset on different markets, protocols, or networks.

So, an Ethereum arbitrage bot is automated software that independently looks for appealing price disparities, but within the Ethereum ecosystem.

In contrast to manual trading, where profitable opportunities are usually gone by the time a trader can react, a bot can monitor, select, and act in seconds or milliseconds.

For example, if ETH is at $1,600 on one cryptocurrency exchange and $1,605 on another, the bot can buy at the cheaper price immediately and sell at the more expensive price for a small profit.

Compared to crypto trading bots produced for other blockchains, Ethereum bots have a few distinctive attributes:

- They must carefully oversee gas fees, which can make or break a trade.

- They directly interact with smart contracts and therefore need secure Web3 integration.

- They face harsh competition in Ethereum’s active mempool, and thus speed and execution strategies matter.

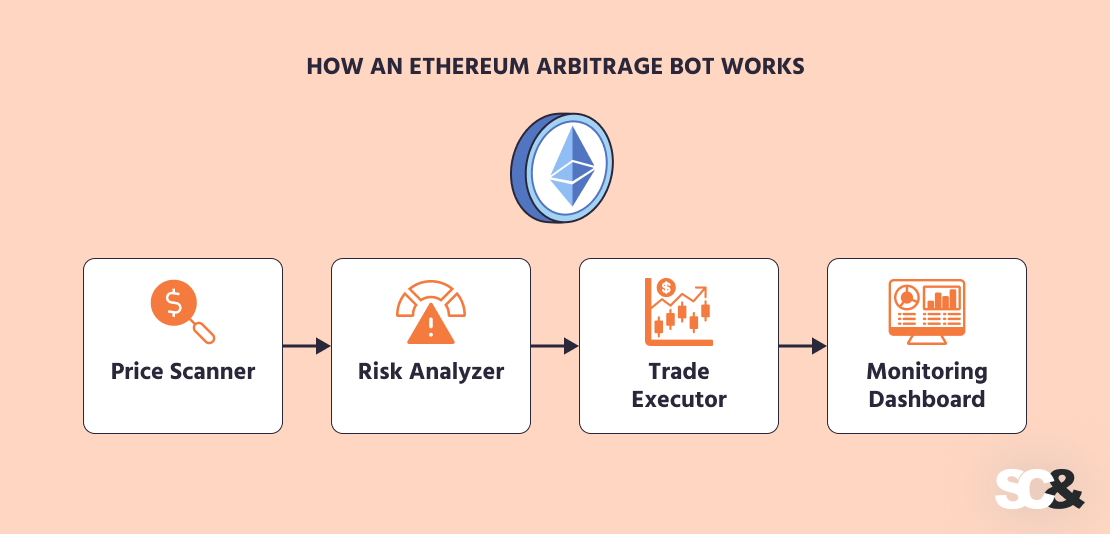

How an Ethereum Arbitrage Bot Works

The Ethereum bot, by way of basic logic and purpose, is pretty much like other crypto arbitrage bots. However, as it is made specifically for Ethereum, it still keeps some peculiarities that set it apart from other bots that work on other blockchains.

Bot Architecture

Generally, Ethereum arbitrage cryptocurrency bots consist of four main elements:

- Market Data Collector – extracts relevant prices from CEXs (centralized exchanges), DEXs, or Ethereum nodes.

- Arbitrage Engine – crosses prices and uncovers profitable options.

- Execution Layer – executes trades, often making all parts of the trade happen atomically.

- Monitoring Dashboard – watches performance, sends signals, and provides control to the trader.

By and large, such a modular format allows flexibility, so bot developers can add new exchanges, adjust algorithms, or tweak execution without overhauling the bot.

Price Scanning

The bot’s intelligence comes from its scanning algorithms. Some simply compare prices on two exchanges, while others track several token pairs for more complex prospects, like triangular arbitrage.

Ethereum bots in DeFi are able to read smart contracts directly using Web3 libraries. In order to seize opportunities fast, they often work in parallel, keep price data ready in memory, and even try to guess short-term price moves.

Execution

Timing of execution in crypto arbitrage is of utmost importance. Upon finding a deal, the bot:

- Executes trades atomically so either all parts succeed or none do.

- Makes use of private transaction channels (i.e., Flashbots) to avoid front-running.

- Scores gas fees to keep costs less than revenue.

Some advanced bots also use simple machine learning to decide whether a trade is worth making based on the current network status.

Ethereum-Specific Tools

Ethereum crypto bots rely on blockchain-native tools:

- Web3 libraries (Web3.js, Web3.py) to interact with nodes and smart contracts.

- EVM (Ethereum Virtual Machine), where transactions are run.

- GraphQL endpoints to query blockchain data efficiently.

- RPC and WebSocket connections for fast, real-time communication.

These technologies allow the bot to scan prices, calculate profits, and execute trades in a hurry before they’re lost.

Technologies and Tools Behind Automated Trading

To make an Ethereum arbitrage trading bot, developers require the right mix of programming languages, blockchain services, and exchange APIs. Since the bot’s success depends on how quickly it can spot and trade, what you develop it with matters a lot.

Programming Languages

- Python – great for testing strategies and connecting to exchange APIs.

- Node.js – well-suited for live data streams and WebSocket connections.

- Golang or Rust – often used when speed and low latency are the concern.

Many bots combine all of these: Python for analysis, Node.js for handling data, and Go or Rust for the fastest parts of the execution.

Blockchain Tools

These tools help bots spot profit opportunities and accomplish trades without delays:

- Flashbots – enable bots to submit private Ethereum transactions to avoid being front-run.

- Blocknative – helps track the mempool so bots can see how transactions are lining up.

- QuickNode (and similar providers) – give fast and reliable access to Ethereum and Layer 2 networks.

Exchange Connections

In order to be profitable, a bot will normally connect to both decentralized and centralized markets:

- CEXs: Binance, Kraken, Coinbase, etc., give extensive liquidity and live order books.

- DEXs: Uniswap, Curve, SushiSwap, and Balancer are well-known Ethereum platforms where price differences are likely to happen.

By combining CEXs and DEXs, bots get more chances to catch profitable trades.

Real Challenges and Limitations of ETH Trading Bot

Blockchain trading software can be pretty much profitable, but the reality is far from uncomplicated. The market is highly competitive, and many technical and financial limitations can cut into possible gains.

Let’s start with competition. There are thousands of traders and bots watching the same markets, many with seasoned teams and infrastructure behind them. Because of this, price discrepancies close in seconds, giving barely any time to react.

Another problem is how trades in Ethereum are settled. When a trade is still unconfirmed, it goes into the mempool, where everyone can view it.

It is therefore possible for other bots to copy the trade and have it executed first by paying a larger gas fee, which is known as front-running. In that situation, the original trade can fail or even result in a loss.

Gas fees are a problem in and of themselves. Ethereum fees change quickly depending on network usage. A trade that seems profitable at first glance can very easily be rendered unprofitable once the gas fee is included. Due to this, bots need to constantly calculate if the spread is big enough to cover fees.

Speed is also a constraint. A bot must process information and send transactions extremely fast in order to win. Even a small lag will result in the opportunity being taken by another faster competitor. That is why profound developers use optimized code, paid RPC nodes, and private transaction relays.

| Challenge | Impact | Solution |

| Market Competition | Fewer profitable opportunities as many bots compete. | Use custom strategies and monitor multiple exchanges/DEXs. |

| Delays & Front-Running | Trades can fail or be overtaken by faster bots. | Optimize execution speed and consider MEV-resistant tools. |

| Speed Requirements | Bots must execute in milliseconds to stay competitive. | Use low-latency infrastructure and efficient code. |

| Security Risks | Vulnerabilities can lead to losses or data breaches. | Implement secure coding, audits, and safe key management. |

| Liquidity & Slippage | Low liquidity can reduce or eliminate profits. | Focus on liquid pairs and adjust trade sizes dynamically. |

| Network & Gas Fees | High fees may wipe out gains. | Monitor fees in real-time and use L2 solutions when possible. |

Challenges and Limitations of Using Bots

Ready-Made Bots vs. Custom Ethereum Trading Bot Development

When it is a matter of using a crypto trading bot, usually there are two alternatives: off-the-shelf solutions or custom ones. Both have serious pros, yet cons too.

Off-the-shelf bots are universal due to ease of installation and minimal technical knowledge required. They typically include simple-to-use dashboards and pre-programmed strategies, so traders can start testing in almost no time.

For individuals or small groups, it is a reasonable method of trying arbitrage. The downside, however, is that these bots are available to many traders. Their strategies soon become well-known, and markets adjust fast, which means profits usually shrink over time.

Custom development offers greater control. A bot developed in-house or with a crypto arbitrage trading bot development company, can suit specific trading strategies, be modified to work with specific platforms, and be tuned for performance and security.

Why Choose SCAND?

At SCAND, we specialize in designing, creating, and supporting arbitrage crypto bots so that they can last long and survive market competitiveness.

Our services cover everything from initial architecture planning and exchange integrations to ongoing performance tuning and security enhancements.

In close cooperation with customers, we make sure that every bot is not only technically sound but also well-aligned with the client’s business strategy.

Potential Cases for B2B Clients

For B2B clients, SCAND can develop custom cryptocurrency bots that open up arbitrage opportunities going far beyond simple strategies.

Hedge funds, for example, can automate and scale multiple strategies at once, such as inter-exchange arbitrage on centralized platforms and triangular opportunities on Ethereum DEXs. A SCAND-built bot can process thousands of market signals per second and execute trades faster than any manual approach.

Crypto exchanges can use SCAND-developed bots to manage liquidity, correct price differences across markets, and keep spreads tight. This ensures smoother trading and makes the platform more attractive to both retail and institutional users.

Trading companies entering DeFi can benefit from cross-chain and Layer 2 arbitrage bots built by SCAND. These systems can manage multiple networks, optimize gas costs, and execute complex trades with precision — far above what ready-made solutions allow.

Frequently Asked Questions (FAQs)

What is an Ethereum arbitrage bot?

It is a program that automatically looks for price disparities for Ethereum or related tokens across different markets and executes trades to make a profit. It works much faster than manual trading, acting in seconds or milliseconds.

Why choose a custom bot over a ready-made one?

Pre-built bots are quick and easy to use but are not flexible or profitable in the long term. Custom bots, in turn, can be programmed for multi-strategy use, connect to chosen exchanges or networks, be optimized for performance, and change as the market changes.

Are arbitrage bots risky?

Yes. Front-running, fluctuating gas prices, competing bots, and security threats are some of them. A carefully designed bot with proper security features, however, will reduce these risks.

How can SCAND help businesses?

SCAND builds custom Ethereum bots for B2B clients, taking care of everything from strategy design and system setup to exchange and blockchain integrations, monitoring, and further support. Get in touch with us to book a consultation and get more details.