What the Future Holds for Mobile Payments

Global digitization and the mass use of mobile devices to access the internet are fundamentally changing the way people search for products and process their payments. Customer demands have never been so high as today. Buyers want to spend less time entering their card data to make a purchase, easily pay for their goods even when they don’t have the full amount to make a purchase, fulfill cross-border transactions without any delay, and conveniently buy the desired products at any place and at any time.

In an attempt to effectively satisfy their customers’ demands and provide outstanding customer service, merchants continuously adopt new mobile payment methods. In this article, you’ll discover what are the latest digital payments trends and what is the future like for mobile payments.

Digital payment is undergoing significant transformation spurred by the changes in consumer patterns and the enhancements in the mobile industry. Below are the latest digital payment trends and outstanding digital innovations that are changing the way people pay for their goods.

Biometric Authentication

The use of biometric authentication has already become an integral part of mobile payments. This unique security method allows swiftly verifying customers using their physical characteristics such as facial and iris recognition, fingerprint scanning, voice analysis, and others.

Biometric authentication is quickly spreading around the globe. In its latest survey, Visa has found out that Americans are interested in using biometrics for payments as it’s more convenient than remembering various passwords and PIN numbers and more secure due to identity verification.

In 2021, 2.5 mln debit and credit cards with biometric capacity were issued. Meanwhile, there are over 80% of mobile phones empowered with biometrics features that facilitate mobile payment in various applications, including mobile banking.

Gen Z: The Tech-Savvy Generation Z

Gen Z is the first generation born with mobile gadgets in their hands. Those young people that are 7-20 years old today are quickly becoming active members of society and, therefore, consumers as well.

McKinsey& Company calls Gen-Z’s “the generation of true digital natives” that have their own views on goods consumption and interaction with brands. This generation relies more on online communities than their predecessors and praises a communal economy when goods and services can be shared. This gives a boost to the development of such services as Buy Now Pay Later (BNPL), Neobanking, alternative credit scoring, and many others.

Increasing Demand for Mobile Point of Sale

Mobile gadgets provide a wide range of digital payment methods to customers but they’re not limited only to accepting payments. The recently emerged technology of mobile point of sale allows mobile users to process transactions from credit and debit cards virtually anywhere.

Mobile point of sale (mPOS) replaces traditional cash registers and sale terminals, providing a wireless and flexible method of finalising transactions. Now, merchants can process in-store payments and out-store ones in such places as trade shows, food trucks, concerts, craft fairs, farmer’s markets, and more. Moreover, customers don’t have to take their goods to the checkout, instead, they can make a purchase with any employee in the shop.

Smart Speaker Payments

Although smart assistants have only recently appeared, they’ve come and permanently settled in the lives of many customers. According to Statista, there were about 4.2 bln digital voice assistants used around the world in 2020, and the number is expected to increase to 8.4 bln digital assistant units by 2024.

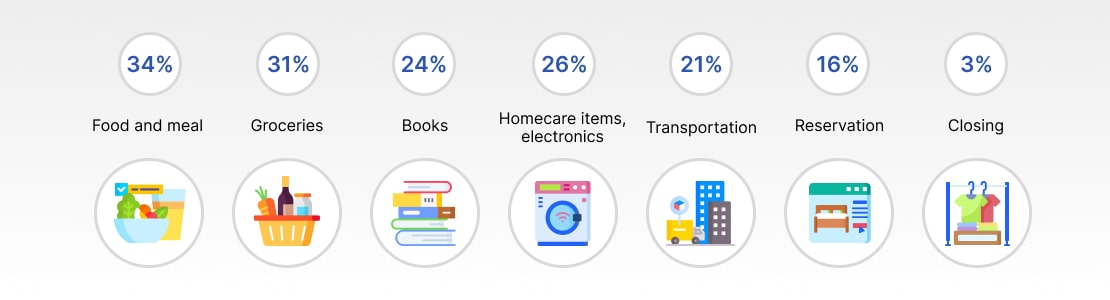

Meanwhile, PWC in its study has found out that 50% of voice assistant users have made purchases with their help and 25% will consider doing so in the future. The majority of voice assistance purchases account for food and meal – 34%, groceries -31%, books – 24%, homecare items, electronics – 26%, transportation – 21%, reservation -16%, and closing -3%.

Top-Rated Security Powered by AI and Machine Learning

Artificial Intelligence and Machine Learning (AI and ML) are widely used for building various payment processing features. Also, they’re implemented to enhance digital security for mobile payments. Banks and financial organisations implement AI and ML algorithms to identify fraudulent transactions.

AI and ML technologies help to process transactions, analyse the transactions behaviour, and find out common customer behaviour patterns.

Contactless Payments

Contactless payments are the digital payment method that has become viral during the Covid-19 pandemic and keeps on growing in popularity in 2022. This type of payment uses NFC (near-field communication) technology to allow customers to quickly wave their credit or debit cards over a card reader and avoid any interaction with it such as entering a PIN. As a result, customers feel more protected as they don’t have to physically touch any surfaces.

Contactless payments are a flexible and quick method. Many companies such as Apple, Google, Samsung, and others incorporate the technology in their mobile phones. The Insider states that contactless mobile payment users worldwide will grow from 1,182.6 million users in 2020 to 1,496.7 million by 2025. Given this, the fastest contactless adopters are China – 87.3%, South Korea – 45.6%, the US – 43.2%, India 40.1%, Japan – 34.9%, Canada – 29.1%, and many others.

Dominance of Mobile Wallets

Mobile wallets are another digital payment solution accelerated by the Covid-19 pandemic that has become a viable alternative to conventional payment methods. It allows underbanked users to quickly become financially active online and get access to various digital services. Therefore, mobile wallets are largely adopted across the countries where financial inclusion is at a low rate such as South Asia, Africa, Latin America, and the Middle East.

Installing a mobile wallet solution provides a variety of advantages to customers such as:

- instant completion on transactions;

- no need to enter credit or debit card data – card number, expiry date, CVV code, etc;

- simple payment in brick-and-mortar stores by QR code scanning;

- quick access via biometric authentication or a code;

- payment notification and auto-payment features;

- enhanced security via encrypted payment codes;

- special discounts and offers for users, and much more.

The most popular mobile wallets are PayPal, Apple Pay, Google Pay, Visa Checkout, and many others. According to Juniper research, the digital wallet transaction value will grow by 60% by 2026.

Conclusion

In today’s world of mobile internet dominance, customers want to make their purchases swiftly, conveniently, and securely. Online and offline merchants should provide their customers with this opportunity to ensure outstanding customer experience and buyer retention. Therefore, it’s essential for sellers to keep up with the latest development trends and adopt the latest mobile payment solutions.

If you’re considering developing a payment system from scratch or enhancing an existing one, our team can offer diverse FinTech software development services, including the development of payment solutions and many more.