DeFi Staking Platform Development Company: Full Guide to Building a Secure and Scalable Solution

DeFi, or Decentralized Finance, is a broad notion that refers to financial services made on and provided by a blockchain.

They typically utilize cryptocurrencies to process operations and come under principles of eliminating the middleman, i.e., financial institutions or governments.

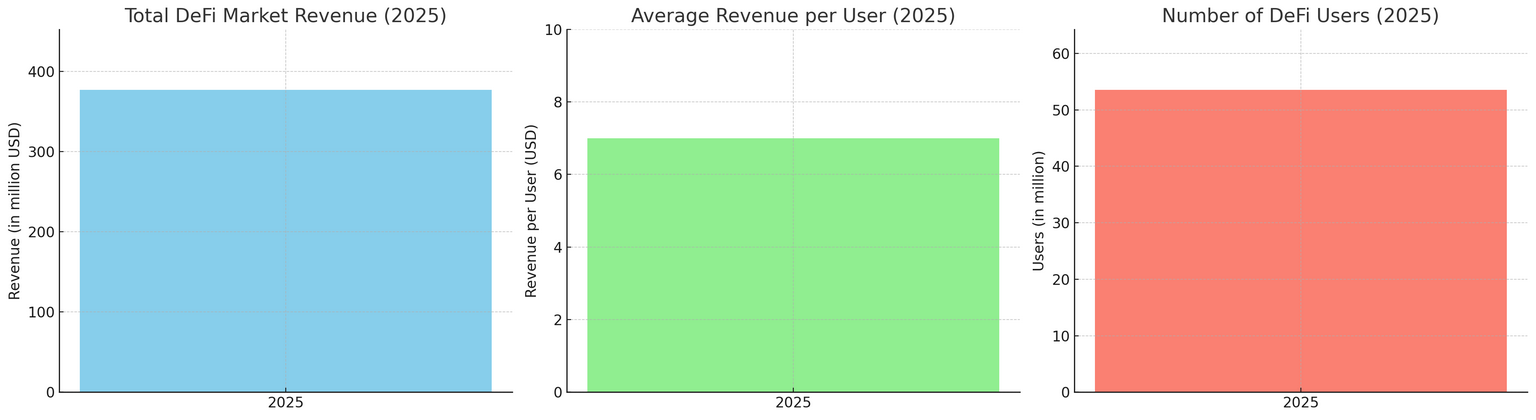

Decentralized finance is a pretty vast domain (53.56m users; $376.9m total cost). It has a large focus on different financial services, such as lending and borrowing, payments, money exchange, and many more.

But the most sought-after service in this ecosystem is staking, a model that allows users to earn passive income while supporting the security and operation of blockchain networks.

How Does DeFi Staking Work?

Staking is the process of locking up cryptocurrency within a blockchain network to secure its operation in return for being rewarded.

It is primarily functional on Proof of Stake (PoS) blockchains, where people “stake” their coins in smart contracts and get paid out in intervals based upon how much and how long they stake.

For example, a person can stake 10 ETH on Ethereum 2.0 and earn about 4–6% annually, or stake SOL on Solana through a validator and earn staking rewards every day. Generally speaking, the longer and larger the stake, the better the potential return.

Staking can be done quite differently, depending on the “dose” of control and participation stakers would want to have:

- The most practical approach is direct staking, in which users tie up their crypto on the blockchain to assist with its upkeep and then receive rewards for it. It usually demands a significant amount of crypto and some tech setup. For example, staking on Ethereum 2.0 requires having your own validator and a minimum of 32 ETH.

- Delegated staking is less technical. You simply choose a trusted validator and let them stake your tokens for you. You receive your portion of the rewards, but you don’t run anything yourself. An example that is widely used is staking SOL on Solana using the Phantom wallet.

- Pool staking is a type where people come together and unite their tokens into one pool. This model gives a chance of getting rewards distributed to all the members.

- Staking based on exchange is when large cryptocurrency exchanges offer users the ability to stake their tokens through their services. All they need to do is press a button to start accumulating rewards, but they must trust the exchange with their holdings.

Benefits of Crypto Staking for Users and Businesses

On the surface, the obvious usefulness of staking is only for the end users of decentralized platforms because, after all, it offers a way to earn passive income just by holding tokens.

Indeed, staking can be equally beneficial for both DeFi participants and businesses in many ways.

For example, do you know that over 58,000 Bitcoins are currently staked, representing a staking market cap of around $6 billion? That’s a very telling sign that thousands of users think the rewards are more than sufficient to cover the risks.

If staking were such a loss-making activity, it is unlikely that so many participants would agree to experience it.

For Users

To begin with, staking allows individuals to make passive income just by holding and immobilizing their cryptocurrency. Instead of having their coins sit idle in a crypto wallet, they can stake them and receive benefits in the longer term (as they would in a bank earning interest).

Secondly, staking allows users to invest in those projects they are interested in. The majority of staking platforms offer governance capability, thus people can cast their votes on important decisions and set the direction of the project.

Besides that, most staking solutions are non-custodial, so customers retain full control of their possessions while collecting rewards.

For Businesses

From a business standpoint, staking is a great way to involve and retain users. If users are rewarded regularly for possessing a token, then they are likely to stick around on the platform.

Furthermore, staking has the effect of reducing the circulating supply of tokens, hence making prices more stable and market conditions more healthy.

In addition to that, businesses can also gain extra income from staking fees with smaller sums or through entering into reward-sharing arrangements. Especially with DeFi, staking can be used to lure extra liquidity and encourage user interaction on the site.

What Is a DeFi Staking Platform?

A DeFi staking platform is a decentralized application/hub/software that lets users lock up their crypto acquisitions to help support the network or liquidity pool, in exchange for earning dividends (usually interest, governance tokens, or a portion of transaction fees).

Key Features of a DeFi Staking Platform

As the name suggests, the key feature of the staking platform is the ability to stake for a reward. But is this enough to succeed in the crypto market?

Not really. Yes, sometimes less is more. However, to stand out and be successful with users, it is necessary to expand the range of functionality.

The most important feature of any platform is smart contract development. Smart contracts autonomously direct every part of staking, from locking tokens and giving out rewards to enforcing the conditions and limitations.

Next, it’s good to have support for many different cryptocurrencies. Users can stake different coins such as ETH, SOL, or BNB, plus special tokens from liquidity pools or partners. The more options available, the more users the platform can attract.

Additionally, the platform should have tools that show users how much they can earn. These calculators estimate rewards based on how much crypto is staked and for how long, and they update in real time so users can see their earnings grow.

To make the platform better without making it too overloaded, it’s nice to add reminders and alerts about staking, referral bonuses for inviting friends, and a simple dashboard that shows earnings. These small extras can keep users interested and help them understand their progress.

How to Build a DeFi Staking Platform – Step-by-Step

As with any software, developing a Defi platform requires a prudent approach. But as with any similar undertaking, breaking the entire process down into smaller phases will help make the entire journey more painless.

1. Market Research & Business Planning

Before coding a single line, start by fulfilling market analysis. Research the competition, observe what the users require (e.g., range of APY, token types, wallet preferences), and point out what your platform does uniquely.

Next, develop a business plan with your revenue model, tokenomics, roadmap, and regulatory scheme.

2. Choosing the Blockchain (Ethereum, BSC, Solana, etc.)

After that, select the blockchain network that best serves your conditions. Ethereum, for instance, has the richest ecosystem, whereas BNB Smart Chain offers faster and more affordable transactions.

Solana, in turn, has high speeds and scalability. By and large, this selection will influence smart contract development, user experience, as well as overall expense.

3. UI/UX and Frontend Design

The next step is to decide on the design to make staking simple for all user levels. The platform should show live data (like APY, rewards, and token balances), offer staking calculators, and support wallet connections from both desktop and mobile.

4. Partner With a DeFi Staking Platform Development Company

In order to have a decent staking platform, it is advisable to outsource the process to a company specialized in DeFi development services.

They will not only carry out the technical part but also create an entirely custom-made product that goes in line with brand identity, tokenomics, and user expectations.

Partnering with a DeFi staking development company also means faster time-to-market because blockchain developers often use ready-made components.

Additionally, you receive security and compliance embedded from the beginning, which diminishes risks and complies with regulations. Finally, the company will continue to support you so your platform operates well and expands as more individuals sign up.

5. Testing, Security Audits, and Deployment

After development and before launch, it’s necessary to test the software inside and outside, as well as audit smart contracts by a trusted third-party firm. When everything is ready, the platform can be deployed to the mainnet.

6. Post-launch Support & Token Management

Launching the platform doesn’t mean the end of development. You’ll need to watch performance, respond to user suggestions, roll out upgrades, and control token supply and staking rewards.

Recurring updates, substantial support, and clear communication will help your platform grow and make users return.

Successful DeFi Staking Projects You Can Refer to When Making Your Own Software

When developing software, it is often difficult to get started because it is not clear at all in which direction to move.

Looking at well-known DeFi staking projects can give you a better idea of what works, what users expect, and how you can build a platform that stands out from others.

1. Lido Finance (Ethereum, Solana, Polygon)

Lido is a top liquid staking platform. It allows users to stake ETH and other tokens with liquidity by minting stTokens (e.g., stETH). The tokens are available across DeFi protocols to be lent, traded, or farmed.

- TVL (Total value locked): More than $28 billion at its peak

- Blockchain: Ethereum, Solana, Polygon, and others

- Key feature: Liquid staking + wide DeFi integration

2. Rocket Pool (Ethereum)

Rocket Pool is directly focused on decentralized Ethereum staking and allows users to stake small quantities of ETH. Node operators can run their own validators with lower capital requirements, whereas regular users can stake ETH through a pool.

- TVL: Roughly $3 billion

- Blockchain: Ethereum

- Major feature: Decentralized node operation and low-stake involvement

3. PancakeSwap Staking (BSC)

As part of its DeFi bundle, PancakeSwap offers staking via Syrup Pools (we’ve already mentioned it above). Users can stake CAKE tokens to earn rewards in CAKE or other partner tokens.

- TVL: $1–2 billion+

- Blockchain: BNB Smart Chain (BSC)

- Major characteristic: Simple staking UI and cross-token reward pools

Cost of Building a DeFi Staking Platform

The cornerstone of any development project is always price. The cost of creating a DeFi staking platform can vary a lot, depending on what elements you want, how protected it must be, and which blockchain you choose.

Cost Criteria

There are several things that affect the final price:

- Technology stack – Different blockchains (Ethereum, Solana, etc.) and tools normally have different development and gas costs.

- Security – Smart contract auditing is a sheer requirement and may be expensive, but it keeps users safe and prevents them from being hacked.

- Design and user experience – Clear, intuitive screens and dashboards add to the cost but also to user appeal and retention.

- Custom features – Custom parts such as multi-token support, governance, or special reward systems can be cost- and time-intensive to create, but they directly impact your individuality.

Approximate Budget Estimates

Thus, if you are developing an MVP with simple staking, wallet integration, and a minimalist interface, it may cost you between $40,000 and $70,000.

A fully featured platform with custom design, multi-token support, sophisticated smart contracts, audits, and governance tools can cost between $100,000 and $250,000 or more, depending on a combination of components.

| Platform Type | Included Features | Estimated Cost Range |

| Basic MVP | Simple staking, wallet integration, minimal UI | $40,000 – $70,000 |

| Standard Platform | Better UI/UX, basic analytics, support for one token | $70,000 – $120,000 |

| Advanced Platform | Multi-token support, smart contract audit, custom reward logic | $120,000 – $180,000 |

| Enterprise-Grade Solution | Custom UI/UX, full governance, audits, complex smart contracts, scalability tools | $180,000 – $250,000+ |

Why Choose SCAND as a DeFi Staking Platform Development Company?

If you want to build a DeFi staking platform, SCAND is a great partner to work with. We have more than 20 years of software development experience and a strong team of Web3 and blockchain technology specialists.

Our developers know how to create safe and accurate smart contracts, connect crypto wallets, and produce user-oriented Web3 development solutions. We work with major blockchains and use trusted tools like Solidity and Web3.js.

Besides, we take care of every step of development, from planning and design to testing, launch, and support. When you work with us, you get a dedicated team, clear communication, and a solution that’s ready to grow with you.

Frequently Asked Questions (FAQs)

What is the best blockchain for staking platforms?

It depends on what you are trying to do. Ethereum is well-tested and trusted, but costly. BSC and Polygon are quicker and cheaper. Solana is best for high-frequency apps.

How much does it cost to create a staking platform?

Again, it depends on many criteria. MVPs start at $40,000. A fully functional staking platform can be over $100,000 based on complexity.

Can I integrate multiple tokens and rewards?

Yes, if needed, we can integrate multi-token staking and customizable reward logic into the smart contracts.

Is it possible to run a staking platform legally?

That depends on the area you are in and the laws it adheres to. In certain regions, staking is a financial service. In some territories, it can be regarded as an illegal activity. We recommend that you study the legislation or contact specialized professionals for advice.