Cross‑Chain DEX Arbitrage Bot: What It Is and How to Build One

According to statistics, decentralized exchanges (DEXs) over the last 3-4 years have become a major part of Decentralized Finance (DeFi).

PancakeSwap’s 24-hour trading volume, for example, reaches $7.39 billion, Uniswap’s — $3.98 billion, and Fluid’s — $1.77 billion.

However, despite all the seeming profitability, the trading process on DEXs is characterized by fragmentation — not only across trading pairs and protocols but also across entire blockchain networks.

The same asset can have somewhat varying prices on different chains, depending on liquidity, supply and demand imbalances, and transaction speeds.

In practice, it’s nearly impossible to carry out asset buying and reselling manually because prices change in seconds. This is why many crypto traders use cross-chain DEX arbitrage bots.

Top DEXs Ranked by 24h Trading Volume, DefiLlama

What Is Cross‑Chain DEX Arbitrage?

Cross-chain DEX arbitrage consists of buying a token on one chain and selling the same token on a DEX on another, all to capitalize on price differences.

These gaps can arise based on differences in liquidity, volumes, or how fast the price is being updated between networks.

For example, suppose a token is priced at $98 on a DEX on Avalanche but $100 on a DEX on Ethereum. A trader (or preferably a bot) can buy the token on Avalanche at a lower price and sell it on Ethereum for a $2 profit per token (after fees).

Arbitrage of this kind maintains prices in equilibrium across blockchains, but the window of opportunity typically shuts in a matter of seconds. That’s why using bots to swap assets becomes a necessity.

What Is a Cross‑Chain DEX Arbitrage Bot?

A cross-chain DEX arbitrage bot is an automated program that observes token prices across multiple exchanges on different blockchains.

When it detects a price disparity significant enough to cover fees and slippage, it executes a series of trades between them to reap the difference.

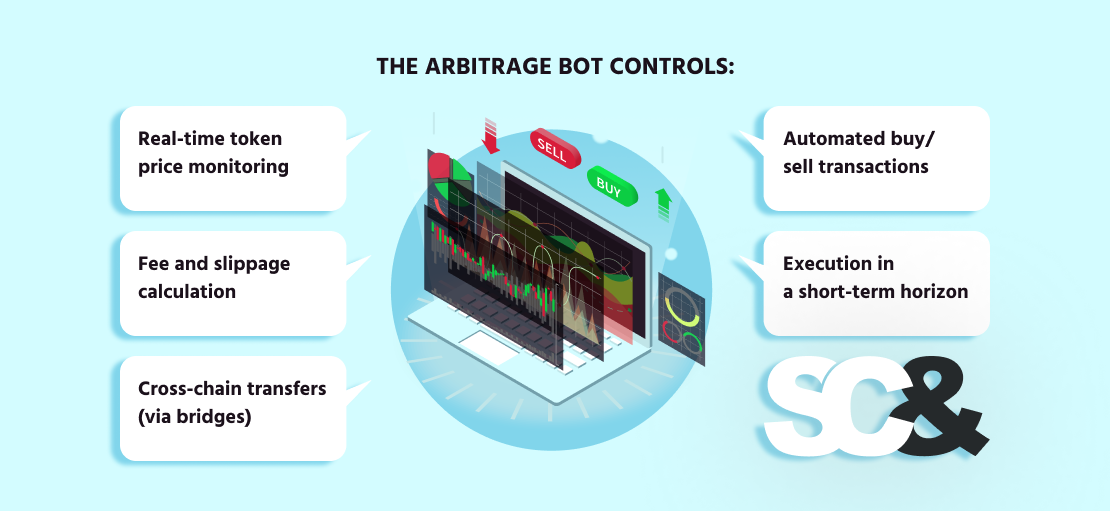

These bots are necessary in cross-chain scenarios, where manual execution would be too late and entirely miss the opportunity. The arbitrage bot controls:

- Real-time token price monitoring

- Fee, slippage, and profitability calculation

- Cross-chain transfers (via bridges)

- Automated buy/sell transactions

- Frontrun and backrun execution

Key Components of a Cross‑Chain Arbitrage Bot

A cross-chain arbitrage bot always needs to include a few components in order to detect price dissimilarities and make trades in a timely manner.

Arbitrage Logic

This is the core of the bot. It keeps track of token prices on different DEXs (Ethereum, BSC) and figures out when a price difference is big enough to make a profit after gas fees, bridge fees, and slippage.

But to really stay ahead, the bot should also look at a few less obvious aspects:

- Other bots: There may already be bots trading on the same DEXs. It’s useful to track their activity because they can affect prices before your bot does.

- Market makers: Some tokens are supported by market makers who have their own trading strategies to keep the market liquid. Knowing how they behave helps avoid chasing misleading opportunities.

- Trading stats: Analyzing trade volume and activity over the last 7–30 days can give your bot a better sense of which opportunities are worth going after.

DEX Connections

To trade on decentralized exchanges like Uniswap, PancakeSwap, or SushiSwap, your bot needs to connect directly to the blockchain not just through API, but by using a node.

Connecting through a blockchain node lets the bot read data straight from smart contracts, which is faster and more reliable than most APIs. In some cases, it can even track the mempool, giving your bot a chance to spot price changes before they happen on-chain.

Cross-Chain Bridge Support

Since the bot works on different blockchains, it needs a way to move tokens between them. That’s where bridges like Axelar, LayerZero, or Wormhole come in; they transfer assets from one chain to another.

Blockchain Access (RPC Nodes)

To get up-to-date blockchain data and send transactions, the trading bot uses RPC endpoints, which represent a sort of gateway to each blockchain network.

In most cases, this means running your own full nodes. Public RPC endpoints are often slow, unreliable, or limited in rate, which can cause delays and missed opportunities.

By setting up your own blockchain infrastructure, you ensure fast access to on-chain data, which is critical not only for quickly sending trades but also for calculating profitability and reacting to market changes in real time.

Automation Engine

The backend of an arbitrage bot usually has two parts, each doing a different job:

- Fast Layer – Trading Core: This is the part that does all the real-time work. It’s multithreaded, keeps everything in memory, and reacts quickly to price changes. It checks prices, calculates potential profits, and sends trades—fast. The goal here is speed, so the bot avoids delays and doesn’t wait on outside systems.

- Slow Layer – Data & Management: This part takes care of everything that doesn’t need to happen instantly. It stores trade history, tracks stats, saves logs, and handles any user-facing features if needed. It’s focused on analysis and long-term control, not speed.

Wallet Management

The bot needs crypto wallets on each blockchain to hold the tokens it trades. These wallets also pay for gas fees, so it’s important to keep them protected and funded.

Safety and Risk Controls

To avoid inadequate trades, the bot should have limits in place, for example, how much slippage is okay, how much gas it’s willing to pay, or what to do if something goes wrong with a bridge or trade.

In many cases, the bot also uses its own smart contract to handle trades or move tokens between blockchains. However, since this contract holds funds and interacts with DEXs, it can become a target for hackers. That’s why it’s very important to audit the smart contract and check for vulnerabilities before using it.

Challenges and Risks When Using Arbitrage Bots

Running a cross-chain arbitrage bot can seem like earning money the easy way on decentralized exchanges, but it is filled with several challenges.

To start with, arbitrage opportunities don’t last long — in some cases, just a few seconds. If the bot or the network is exposed to latency or inefficiency, the price disparity may disappear before the trade is completed.

Gas charges are another problem. On some blockchains, transaction fees may jump unexpectedly. If these fees are more than what you expect your return on investment to be, then you may lose money instead of making it.

And don’t forget about competition. There are lots of other bots out there gunning for the same target, with greater resources and faster set-ups. The fiercer the environment, the harder it is to win.

Best Practices to Use Arbitrage Bots

Running a cross-chain arbitrage bot can be rewarding, but it also takes care and attention to do it right.

First of all, always test your bot on testnets before using real money. This lets you see how it performs in real blockchain conditions, without the risk. You can fix bugs, improve your logic, and build confidence before going live.

Once your bot is live, it’s important to focus only on clearly profitable trades. Not every price difference is worth chasing. Many are too small, and once you subtract gas fees, bridge costs, and slippage, you might end up losing money.

Before sending real trades, you can also run your bot on mainnet in dry-run mode. In this mode, the bot calculates potential profits and logs what it would have done, but doesn’t actually send transactions to the blockchain. This is a useful step to test your strategy in real market conditions and see if it’s truly profitable.

Your bot also needs fast and reliable access to the blockchains it works with, and that means building your own infrastructure with dedicated nodes. Public RPC endpoints are often too slow or unreliable to compete with other bots. If your data is delayed even by a second, you could miss profitable trades.

And don’t rush into it with large amounts. Start small while you test your bot with real trades. As your bot proves itself and your budget grows, it’s important to add more security measures: set tighter limits, monitor activity, and audit your smart contract and infrastructure.

Once your bot starts showing results and moving real volume, you’ll likely attract attention, not just from other traders, but from hackers too. If you’re visible, assume at least ten people are already watching what you’re doing. Better to be ready than regret later.

Finally, keep improving. The DeFi world changes quickly, so update your bot regularly. Watch for new tools, DEXs, and strategies that might give you an edge.

| Tip | Summary |

| Test First | Use testnets to fix bugs and fine-tune before risking real funds. |

| Trade Smart | Only go for clearly profitable trades after fees and slippage. |

| Reliable Access | Use stable RPCs with backups to avoid missed opportunities. |

| Start Small | Begin with small amounts, scale up as confidence grows. |

| Stay Updated | Keep improving your bot as DeFi tools and DEXs evolve. |

Build vs. Buy: Should You Code Your Own or Use an Existing Platform?

When deciding how to make a cross-chain arbitrage bot, one of the first questions to consider is whether you’ll make it yourself or use a solution that already exists. There is no one way; it comes down solely to experience, time, and your goals.

Build Your Own

Building your own bot gives you full control. You can decide how it works, what chains and DEXs it connects to, how it balances risks, and if it should be aggressive or conservative.

If you’re interested in creating a new strategy or gradual optimization over time, starting from scratch is the route to take.

But assembling a bot also takes time and serious technical know-how. If you do it yourself, you’ll need to understand blockchain development, smart contracts, APIs, cross-chain bridges, gas optimization, and more. And while you’re busy coding, you might miss real trading opportunities.

That’s where a crypto trading bot development company like SCAND can help. With over 25 years of software development experience and a deep priority on blockchain solutions, we can help you design, create, and refine a custom arbitrage bot that serves your strategy and scales with your needs.

Buy or Customize

Using an existing platform is a much faster way to get started. Much of the software on the market comes pre-built with features such as dashboards, monitoring trades, and alerts. You don’t need to develop all of this from scratch, and you’ll be able to test actual trades sooner.

Nonetheless, these tools are usually less flexible. You may not be able to adjust its parts to match your exact strategy. Some platforms also charge fees or take a cut of your profits.

There’s also a middle option: start with an open-source bot and customize it, for example, using the Bot Starter Kit from SCAND. It gives you a working base to build on, and you still get some flexibility without starting from zero.

Frequently Asked Questions (FAQs)

Is arbitrage legal?

Yes, crypto arbitrage is legal in most jurisdictions. However, always consult local laws and regulations.

Do I need a lot of capital to start?

Not necessarily, but higher capital can cover gas costs and encourage more profitable trades.

What’s the difference between cross-chain and on-chain arbitrage?

On-chain arbitrage involves trades within the same blockchain. Cross-chain arbitrage spans multiple blockchains and requires bridging assets between them.

Can I still make money with arbitrage bots in 2025?

Yes. But it’s harder than ever. The easy wins from 2020–2021 are mostly gone. Today’s profits often depend on faster execution, access to obscure chains, and smarter algorithms. You’re now competing against highly optimized bots and institutional-grade systems.